China has officially banned cybersecurity software from a dozen U.S. and Israeli firms – including Broadcom (AVGO)-owned VMware – citing “national security concerns.”

AVGO shares are inching down at the time of writing following this announcement that’s part of Beijing’s broader push to replace Western technology with domestic alternatives.

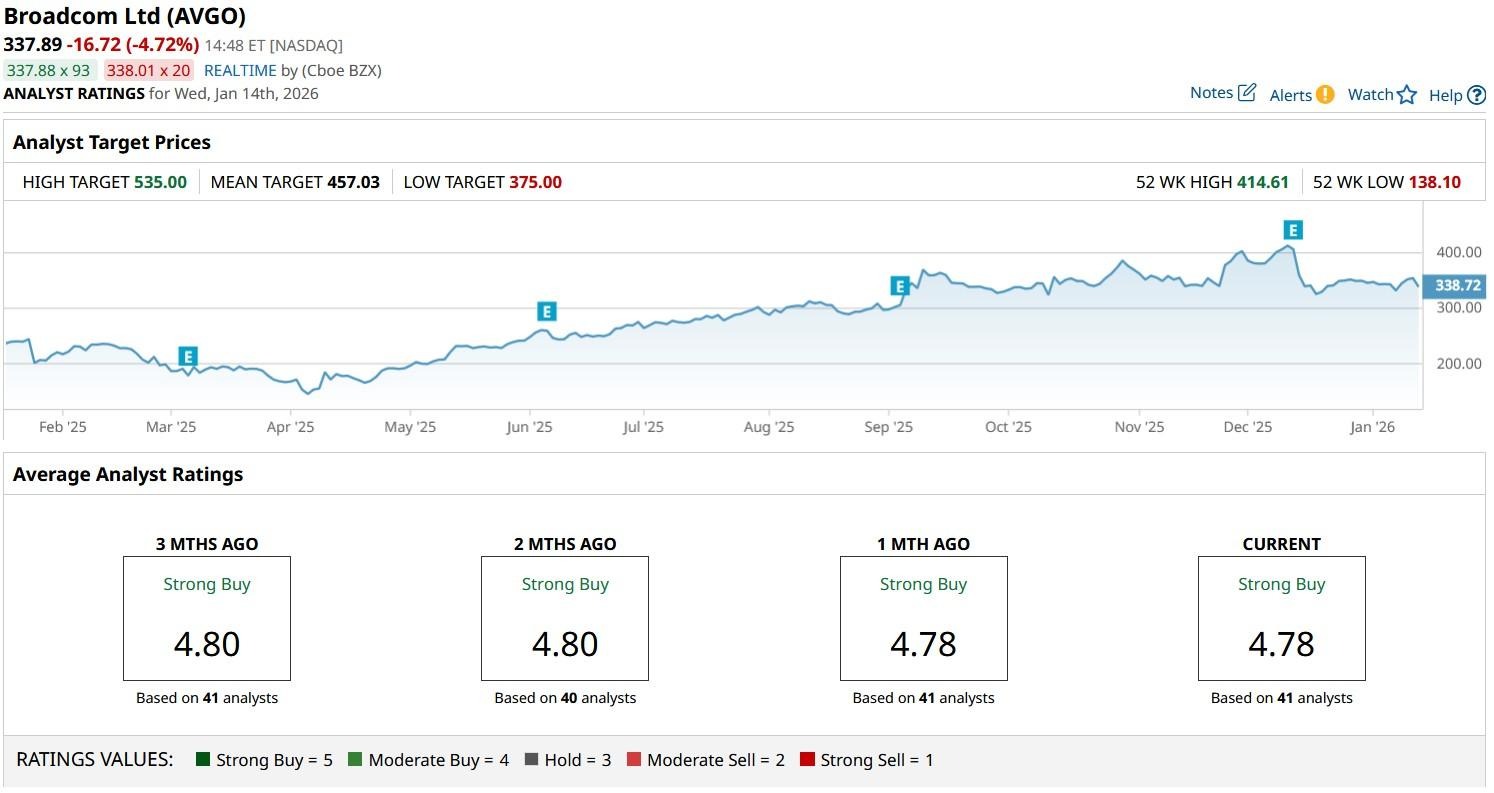

Including today’s decline, Broadcom stock is down more than 18% versus its 52-week high.

Why Is the China News Negative for Broadcom Stock?

China’s newly announced ban strikes right at the heart of AVGO’s enterprise software ambition.

Losing access to its cybersecurity clients in Asia’s largest economy not only erodes revenue, but undermines Broadcom’s ability to compete against global rivals, especially ones in the European Union, as well.

Moreover, the ban raises geopolitical risk premiums, reminding investors that American tech firms remain vulnerable to retaliatory measures amid the ongoing U.S.-China rivalry.

Collectively, this means near-term earnings pressure and heightened uncertainty around the giant’s international expansion strategy, which may sustain downward pressure on AVGO stock in the days ahead.

Are AVGO Shares Still Worth Owning in 2026?

Despite the China setback, Broadcom shares remain worth owning mostly because the company’s revenue base isn’t concentrated on cybersecurity.

It has a fairly diversified business spanning networking chips, enterprise software, and custom AI accelerators, supporting consistent double-digit earnings growth.

In 2025, the Nasdaq-listed firm signed a $10 billion agreement with Anthropic and another much bigger deal with OpenAI, reinforcing its status as a semiconductor powerhouse.

AVGO is attractive also because it’s trading at a forward price-to-earnings (P/E) multiple of about 42x at the time of writing, which isn’t expensive for a fast-growing AI stock.

In fact, Mizuho analysts raised their price target on Broadcom this morning to $480, indicating potential upside of roughly 45% from here.

What’s the Consensus Rating on Broadcom?

Other Wall Street firms seem to agree with Mizuho on AVGO shares especially since they currently pay a dividend yield of 0.77% as well.

According to Barchart, the consensus rating on Broadcom stock sits at “Strong Buy” with the mean target of about $457 signaling potential for another 35% rally from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Google vs. Apple: Which Magnificent 7 Stock is a Better Buy Right Now?

- Should You Buy or Sell Nvidia Stock Amid China’s H200 Whiplash?

- Morgan Stanley Just Upgraded This 1 Lesser-Known Tech Stock. Should You Buy Shares Now?

- China Just Banned Broadcom’s Cybersecurity Solutions. What Does That Mean for AVGO Stock?