Ross Stores trades at $153.80 per share and has stayed right on track with the overall market, gaining 5.3% over the last six months. At the same time, the S&P 500 has returned 9.7%.

Is now the time to buy ROST? Find out in our full research report, it’s free.

Why Does ROST Stock Spark Debate?

Selling excess inventory or overstocked items from other retailers, Ross Stores (NASDAQ:ROST) is an off-price concept that sells apparel and other goods at prices much lower than department stores.

Two Things to Like:

1. Store Growth Signals an Offensive Strategy

A retailer’s store count often determines how much revenue it can generate.

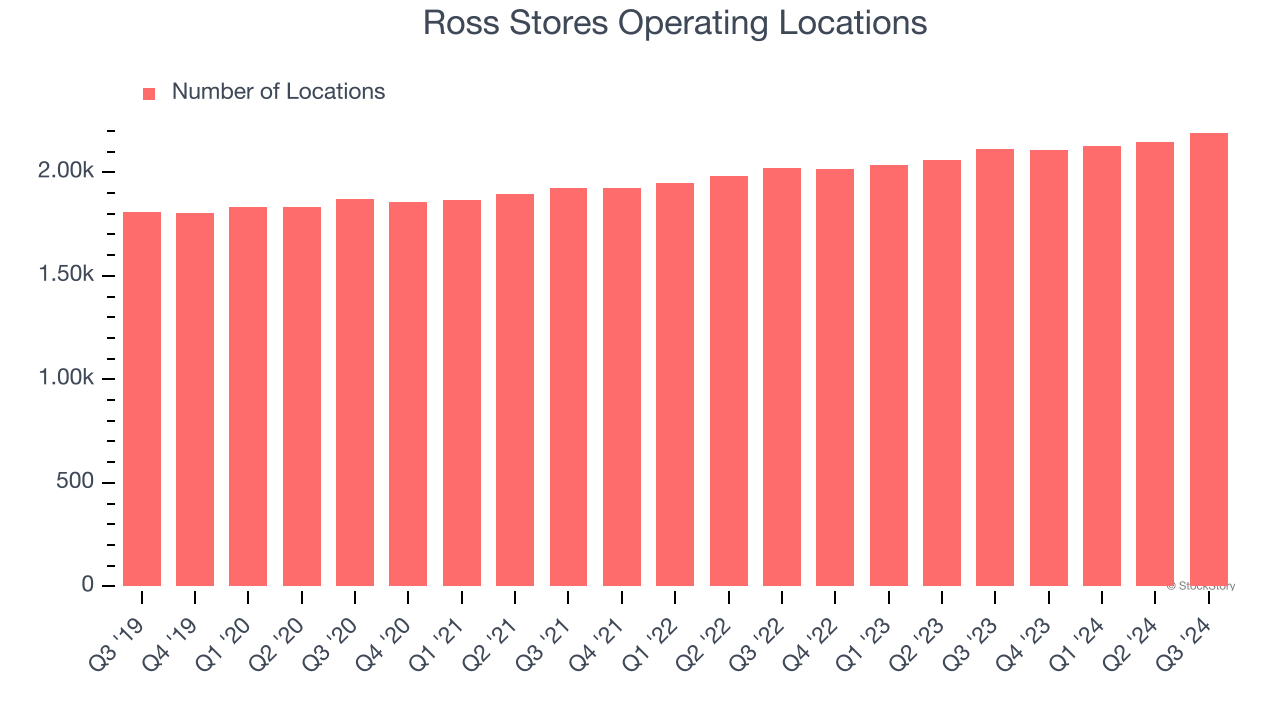

Ross Stores sported 2,192 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 4.4% annual growth, among the fastest in the consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

2. Surging Same-Store Sales Show Increasing Demand

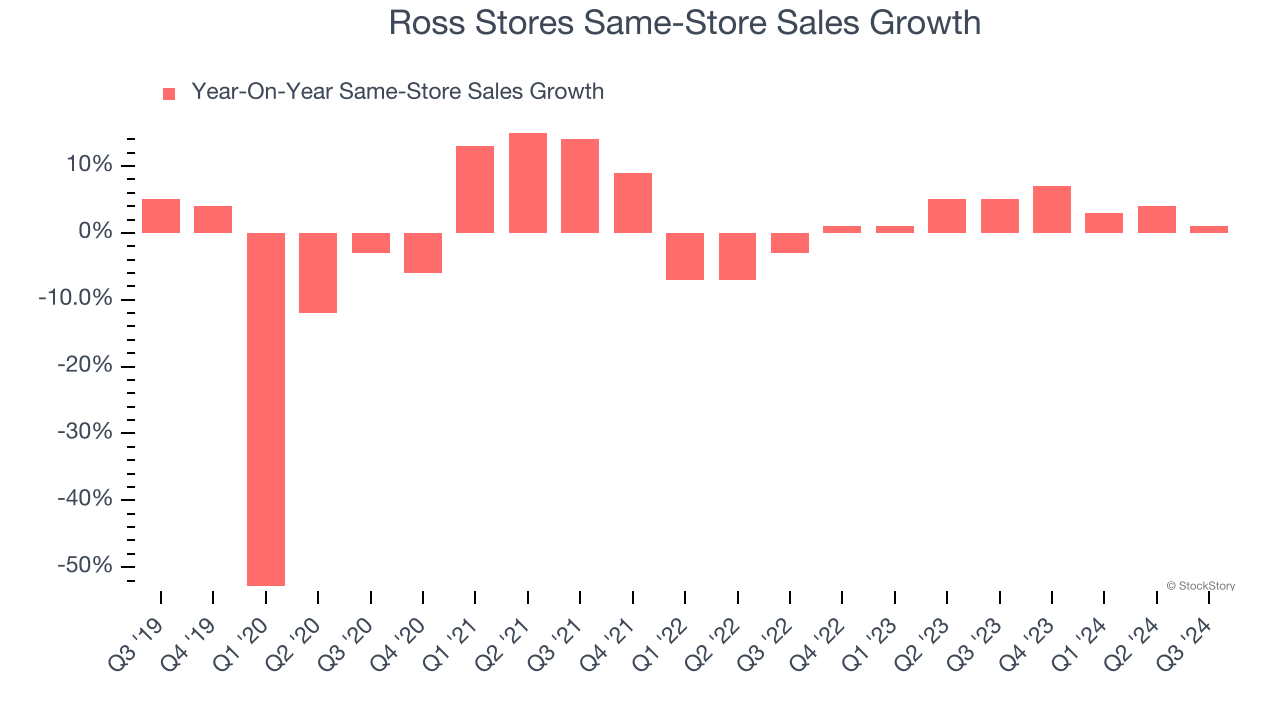

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Ross Stores’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.4% per year.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

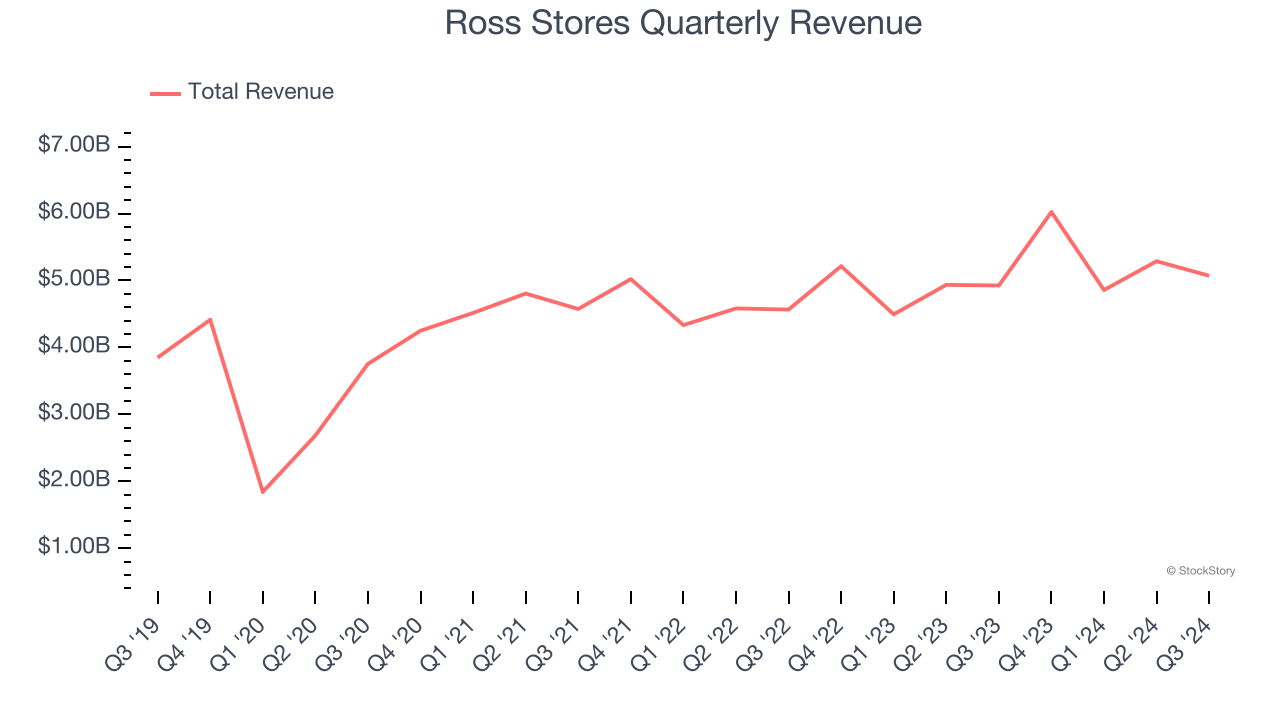

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Ross Stores grew its sales at a tepid 6.2% compounded annual growth rate. This was below our standard for the consumer retail sector.

Final Judgment

Ross Stores has huge potential even though it has some open questions, but at $153.80 per share (or 23.6× forward price-to-earnings), is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Ross Stores

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.