Walgreens’s stock price has taken a beating over the past six months, shedding 20.7% of its value and falling to $9.67 per share. This might have investors contemplating their next move.

Is there a buying opportunity in Walgreens, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.Despite the more favorable entry price, we don't have much confidence in Walgreens. Here are three reasons why we avoid WBA and a stock we'd rather own.

Why Do We Think Walgreens Will Underperform?

Primarily offering prescription medicine, health, and beauty products, Walgreens Boots Alliance (NASDAQ:WBA) is a pharmacy chain formed through the 2014 major merger of American company Walgreens and European company Alliance Boots.

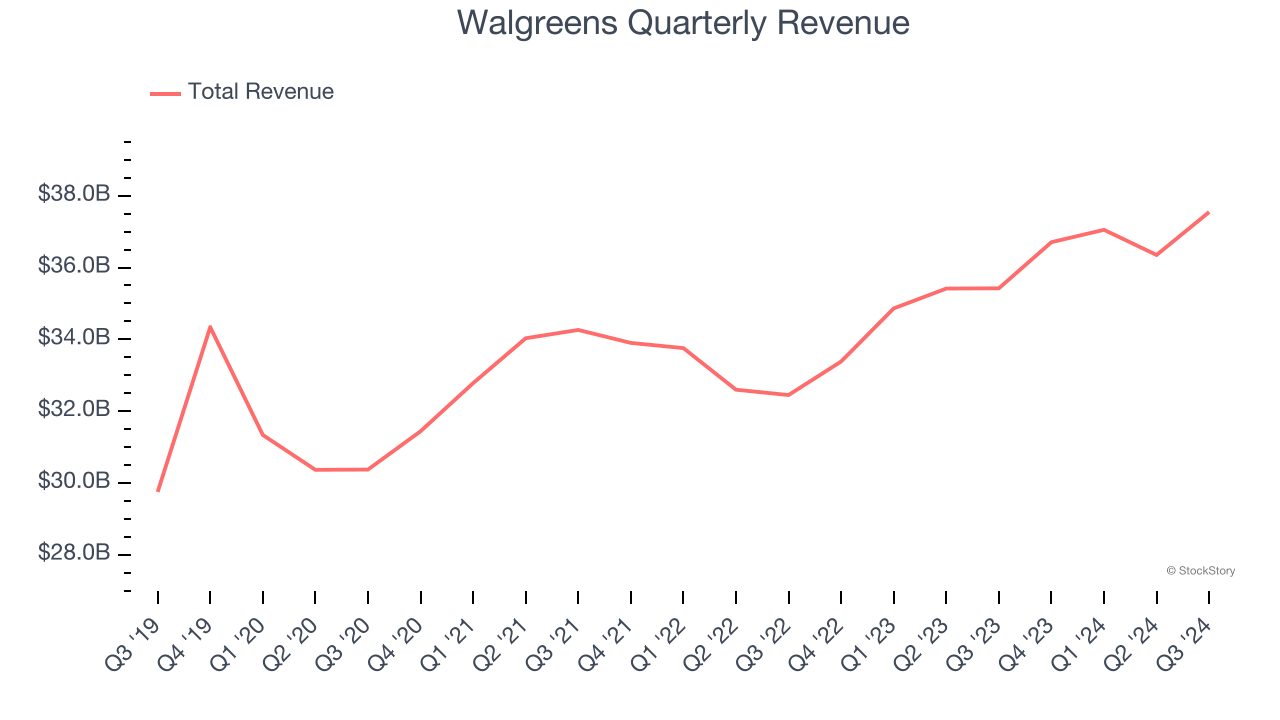

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Walgreens grew its sales at a sluggish 4.2% compounded annual growth rate. This fell short of our benchmark for the consumer retail sector.

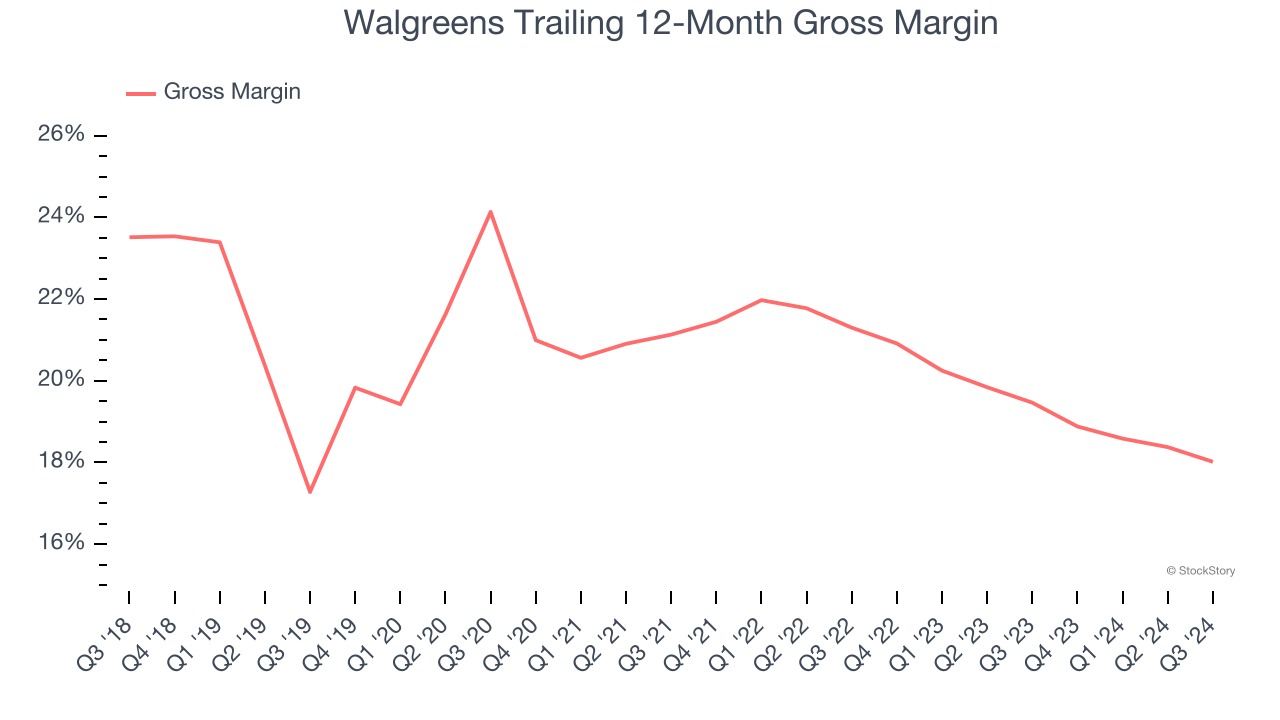

2. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

Walgreens has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 18.7% gross margin over the last two years. Said differently, Walgreens had to pay a chunky $81.28 to its suppliers for every $100 in revenue.

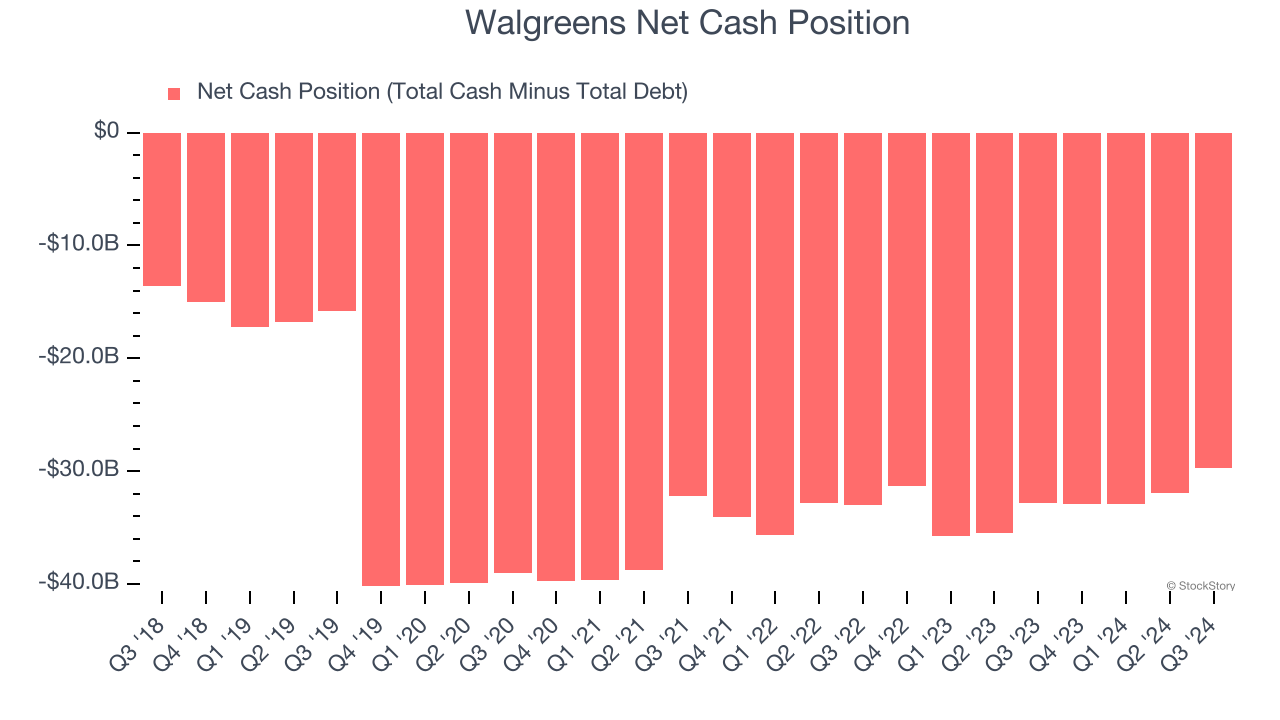

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Walgreens burned through $363 million of cash over the last year, and its $32.85 billion of debt exceeds the $3.11 billion of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Walgreens’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Walgreens until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

We see the value of companies helping consumers, but in the case of Walgreens, we’re out. Following the recent decline, the stock trades at 5.6× forward price-to-earnings (or $9.67 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. Let us point you toward Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Like More Than Walgreens

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.