Regional bank Cathay General Bancorp (NASDAQ:CATY) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 13.7% year on year to $210.6 million. Its GAAP profit of $1.13 per share was 2.1% below analysts’ consensus estimates.

Is now the time to buy Cathay General Bancorp? Find out by accessing our full research report, it’s free for active Edge members.

Cathay General Bancorp (CATY) Q3 CY2025 Highlights:

- Net Interest Income: $189.6 million vs analyst estimates of $187.1 million (12.1% year-on-year growth, 1.3% beat)

- Net Interest Margin: 3.3% vs analyst estimates of 3.3% (3.2 basis point beat)

- Revenue: $210.6 million vs analyst estimates of $202.5 million (13.7% year-on-year growth, 4% beat)

- Efficiency Ratio: 41.8% vs analyst estimates of 44% (218.5 basis point beat)

- EPS (GAAP): $1.13 vs analyst expectations of $1.15 (2.1% miss)

- Tangible Book Value per Share: $36.96 vs analyst estimates of $36.93 (7.6% year-on-year growth, in line)

- Market Capitalization: $3.25 billion

“We are pleased by the continued increase in the net interest margin compared to the second quarter of 2025. During the third quarter, we repurchased 1,070,000 common shares at an average cost of $46.81 per share, for a total of $50.1 million,” commented Chang M. Liu, President and Chief Executive Officer of the Company.

Company Overview

Founded in 1962 with its first branch in Los Angeles' Chinatown, Cathay General Bancorp (NASDAQ:CATY) operates Cathay Bank, providing commercial banking services to businesses and individuals with a strong presence in Asian-American communities.

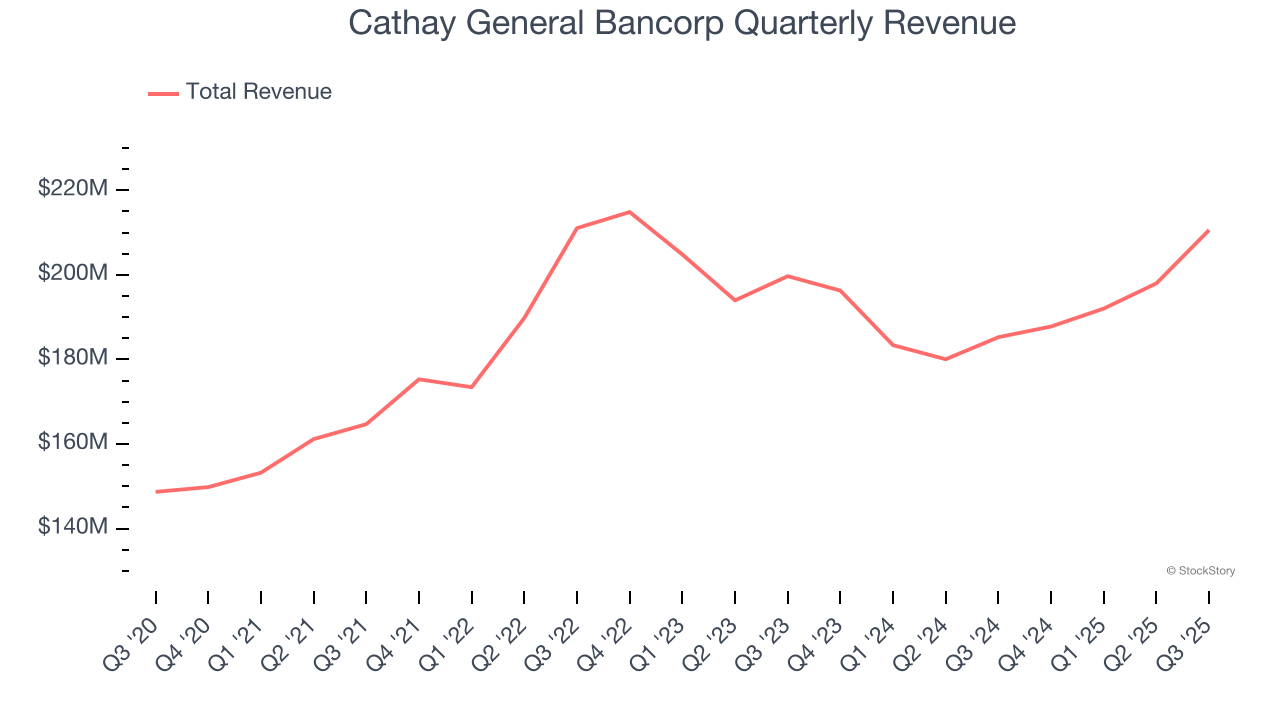

Sales Growth

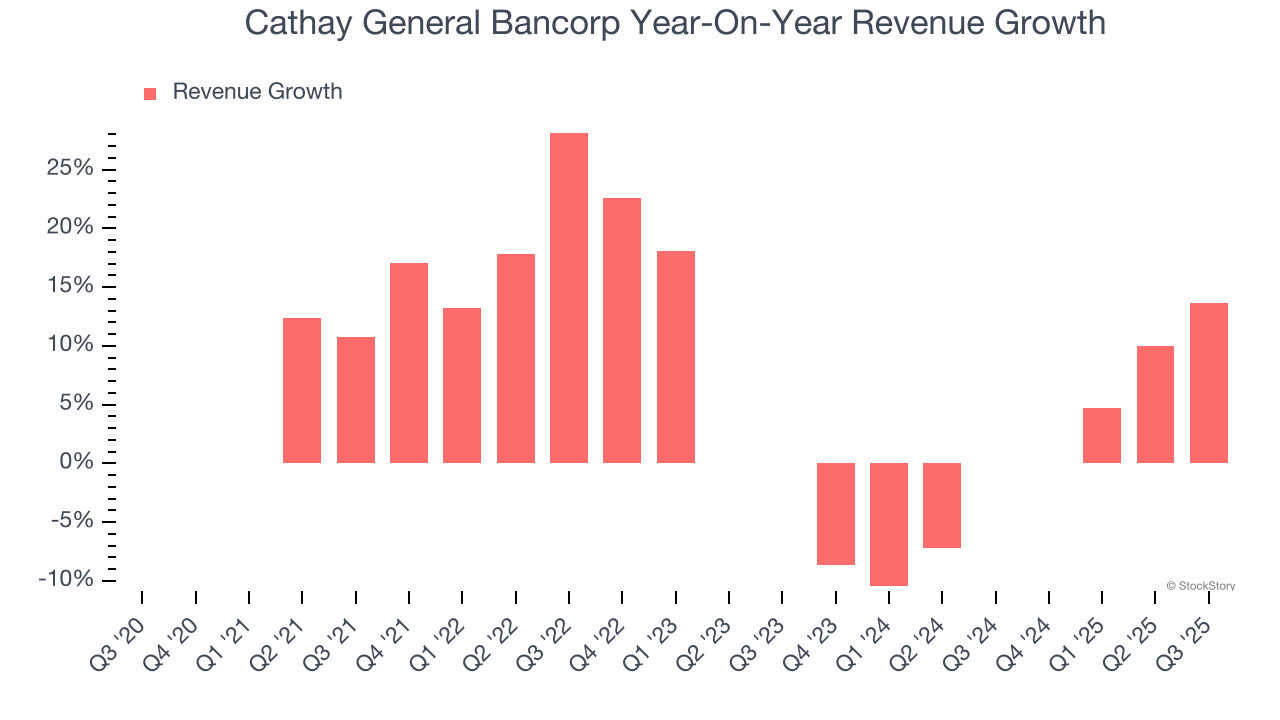

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities. Over the last five years, Cathay General Bancorp grew its revenue at a decent 5.8% compounded annual growth rate. Its growth was slightly above the average banking company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Cathay General Bancorp’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.5% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Cathay General Bancorp reported year-on-year revenue growth of 13.7%, and its $210.6 million of revenue exceeded Wall Street’s estimates by 4%.

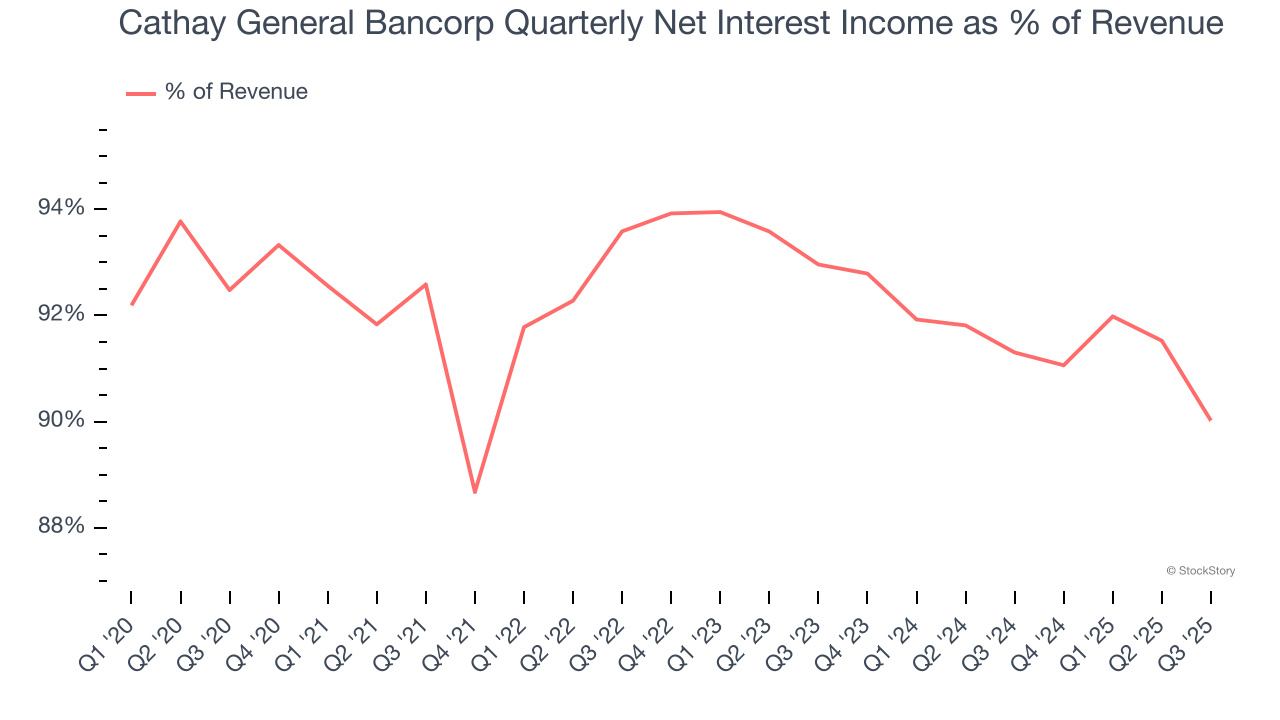

Net interest income made up 92.2% of the company’s total revenue during the last five years, meaning Cathay General Bancorp lives and dies by its lending activities because non-interest income barely moves the needle.

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

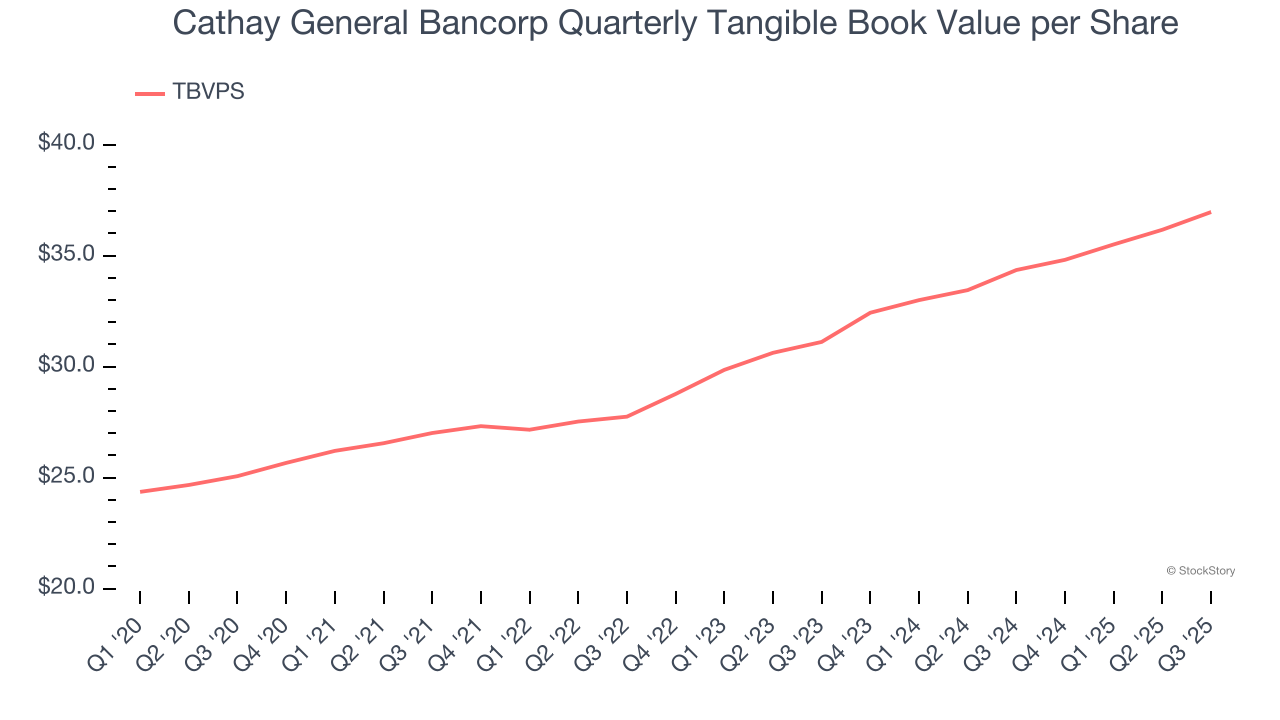

Tangible Book Value Per Share (TBVPS)

Banks profit by intermediating between depositors and borrowers, making them fundamentally balance sheet-driven enterprises. Market participants emphasize balance sheet quality and sustained book value growth when evaluating these institutions.

Because of this, tangible book value per share (TBVPS) emerges as the critical performance benchmark. By excluding intangible assets with uncertain liquidation values, this metric captures real, liquid net worth per share. On the other hand, EPS is often distorted by mergers and flexible loan loss accounting. TBVPS provides clearer performance insights.

Cathay General Bancorp’s TBVPS grew at an excellent 8.1% annual clip over the last five years. The last two years show a similar trajectory as TBVPS grew by 9% annually from $31.11 to $36.96 per share.

Over the next 12 months, Consensus estimates call for Cathay General Bancorp’s TBVPS to grow by 9.1% to $40.32, decent growth rate.

Key Takeaways from Cathay General Bancorp’s Q3 Results

We enjoyed seeing Cathay General Bancorp beat analysts’ revenue expectations this quarter. We were also happy its net interest income narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 2% to $46.19 immediately after reporting.

Is Cathay General Bancorp an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.