Data storage solutions provider Pure Storage (NYSE:PSTG) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 16% year on year to $964.5 million. Guidance for next quarter’s revenue was better than expected at $1.03 billion at the midpoint, 0.7% above analysts’ estimates. Its non-GAAP profit of $0.58 per share was in line with analysts’ consensus estimates.

Is now the time to buy Pure Storage? Find out by accessing our full research report, it’s free for active Edge members.

Pure Storage (PSTG) Q3 CY2025 Highlights:

- Revenue: $964.5 million vs analyst estimates of $955.8 million (16% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.58 vs analyst estimates of $0.58 (in line)

- Adjusted EBITDA: $226.2 million vs analyst estimates of $227.5 million (23.5% margin, 0.6% miss)

- Revenue Guidance for Q4 CY2025 is $1.03 billion at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 5.6%, down from 7.2% in the same quarter last year

- Free Cash Flow Margin: 5.5%, up from 4.2% in the same quarter last year

- Market Capitalization: $29.1 billion

"Pure Storage delivered another strong quarter as global customers increasingly choose Pure to solve their toughest data management challenges," said Charles Giancarlo, Pure Storage CEO and Chairman.

Company Overview

Founded in 2009 as a pioneer in enterprise all-flash storage technology, Pure Storage (NYSE:PSTG) provides all-flash data storage hardware and software that helps organizations manage their data more efficiently across on-premises and cloud environments.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $3.48 billion in revenue over the past 12 months, Pure Storage is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

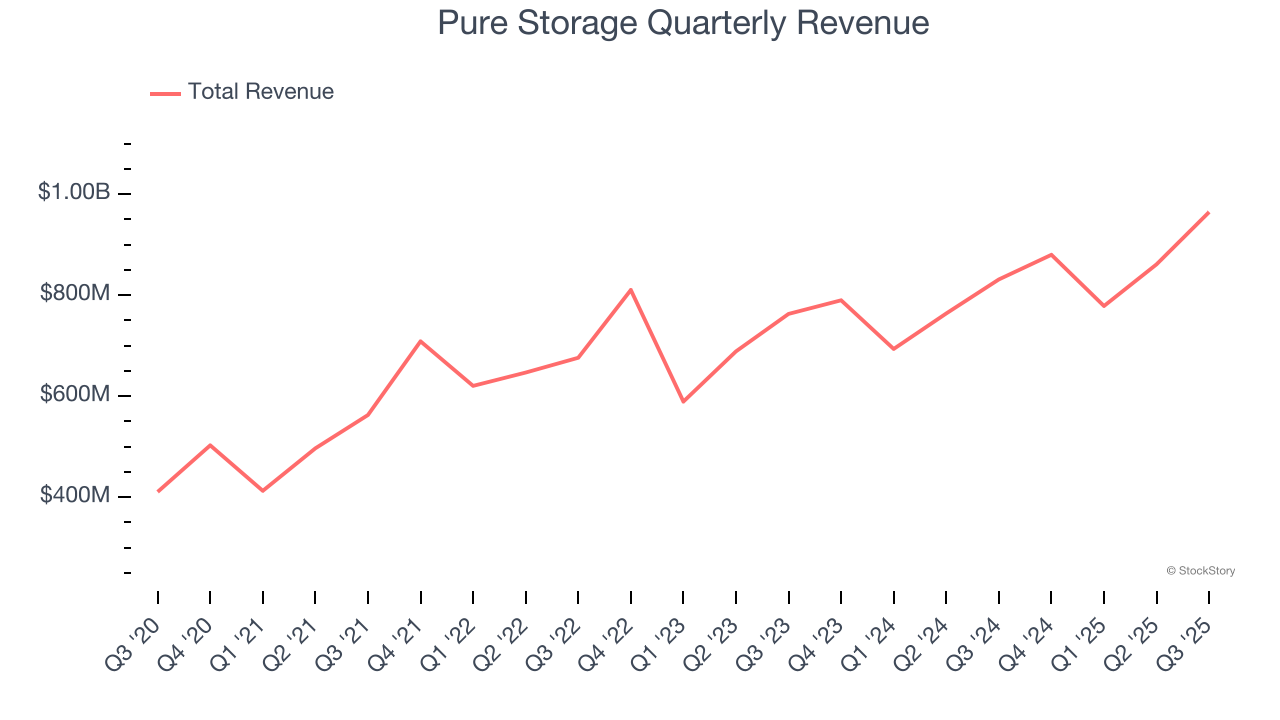

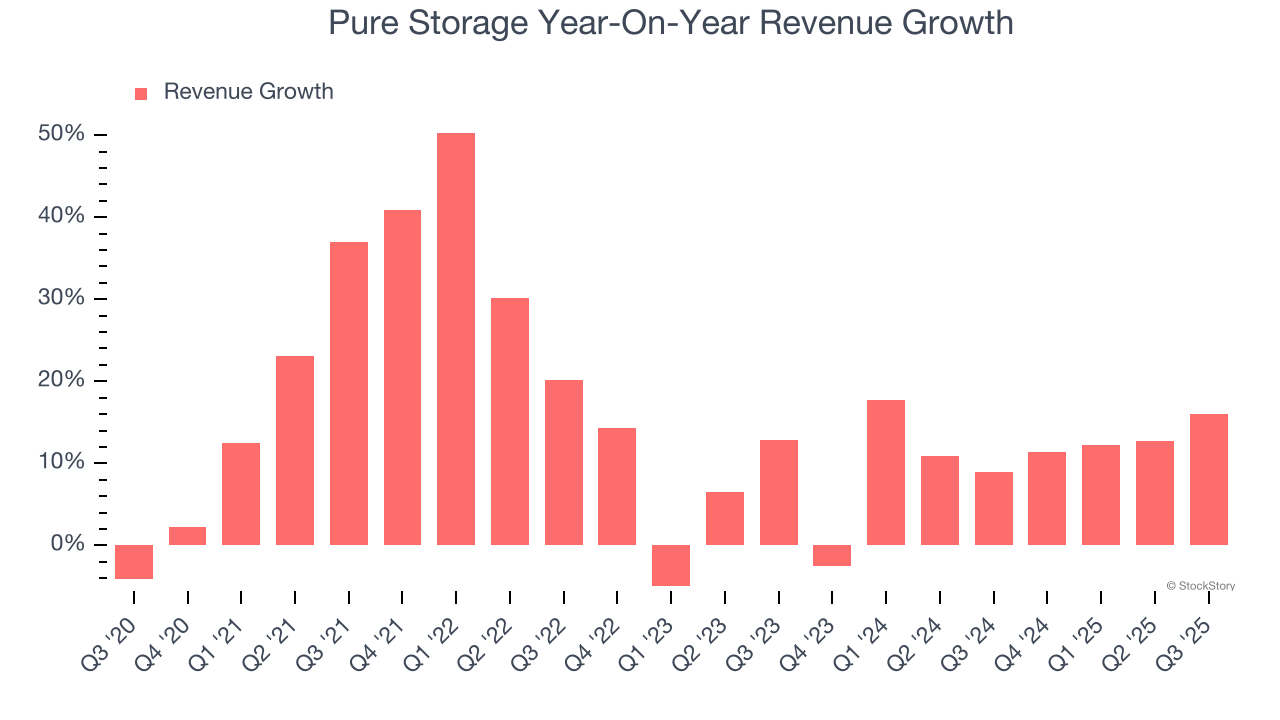

As you can see below, Pure Storage’s 15.8% annualized revenue growth over the last five years was incredible. This is a great starting point for our analysis because it shows Pure Storage’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Pure Storage’s annualized revenue growth of 10.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Pure Storage reported year-on-year revenue growth of 16%, and its $964.5 million of revenue exceeded Wall Street’s estimates by 0.9%. Company management is currently guiding for a 17.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.8% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will spur better top-line performance.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

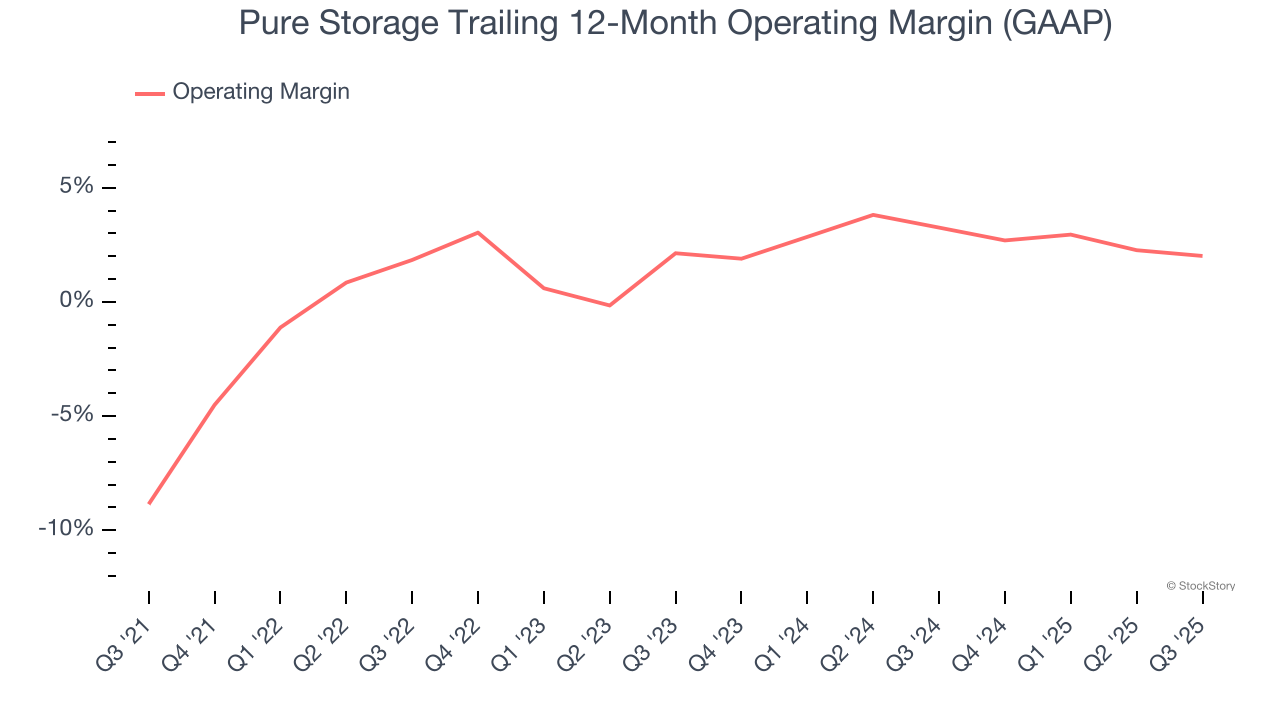

Pure Storage was roughly breakeven when averaging the last five years of quarterly operating profits, inadequate for a business services business.

On the plus side, Pure Storage’s operating margin rose by 10.9 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Pure Storage generated an operating margin profit margin of 5.6%, down 1.6 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

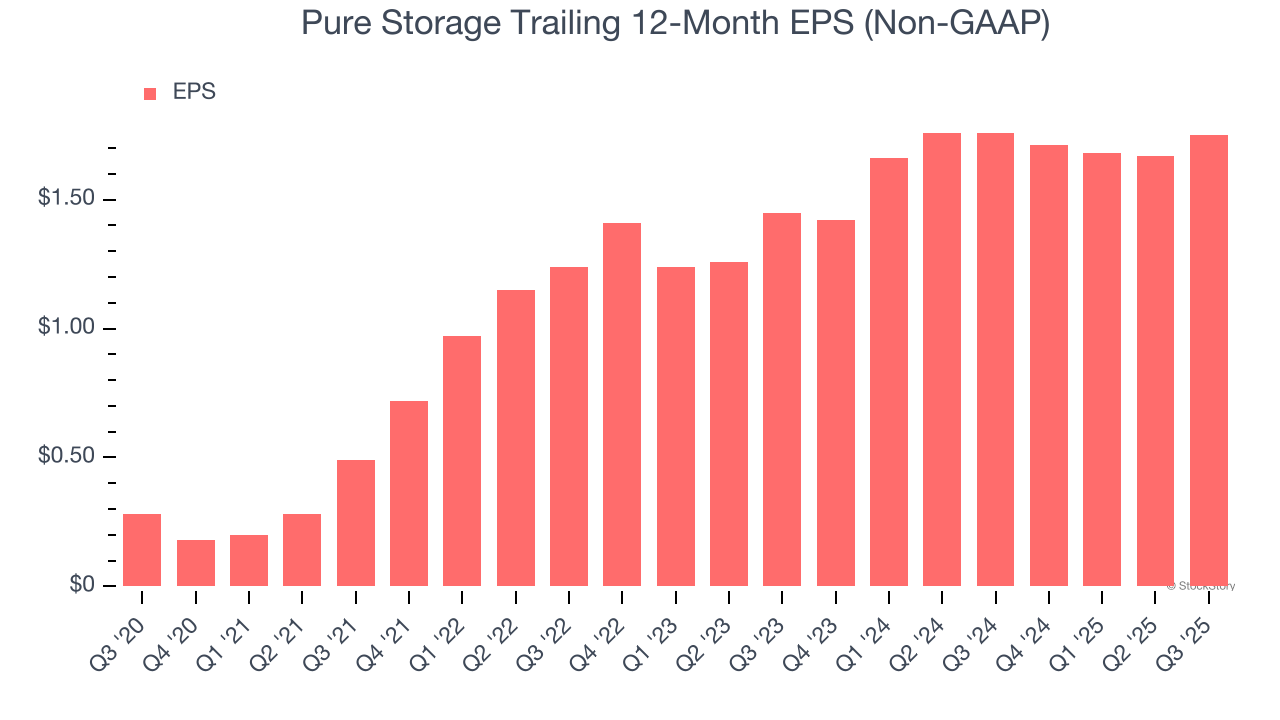

Pure Storage’s EPS grew at an astounding 44.3% compounded annual growth rate over the last five years, higher than its 15.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Pure Storage’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Pure Storage’s operating margin declined this quarter but expanded by 10.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Pure Storage, its two-year annual EPS growth of 9.9% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q3, Pure Storage reported adjusted EPS of $0.58, up from $0.50 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Pure Storage’s full-year EPS of $1.75 to grow 32.8%.

Key Takeaways from Pure Storage’s Q3 Results

It was good to see Pure Storage provide revenue guidance for next quarter that slightly beat analysts’ expectations. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS was in line. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 11.2% to $84.89 immediately following the results.

Is Pure Storage an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.