Automation software company UiPath (NYSE:PATH) announced better-than-expected revenue in Q3 CY2025, with sales up 15.9% year on year to $411.1 million. The company expects next quarter’s revenue to be around $464.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.16 per share was 9.6% above analysts’ consensus estimates.

Is now the time to buy UiPath? Find out by accessing our full research report, it’s free for active Edge members.

UiPath (PATH) Q3 CY2025 Highlights:

- Revenue: $411.1 million vs analyst estimates of $392.8 million (15.9% year-on-year growth, 4.7% beat)

- Adjusted EPS: $0.16 vs analyst estimates of $0.15 (9.6% beat)

- Adjusted Operating Income: $87.78 million vs analyst estimates of $69.98 million (21.4% margin, 25.4% beat)

- Revenue Guidance for Q4 CY2025 is $464.5 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 3.2%, up from -12.2% in the same quarter last year

- Free Cash Flow Margin: 6.1%, down from 11.5% in the previous quarter

- Annual Recurring Revenue: $1.78 billion vs analyst estimates of $1.77 billion (10.9% year-on-year growth, 0.5% beat)

- Market Capitalization: $7.59 billion

“I am pleased with our third quarter results delivering ARR of $1.782 billion, up 11 percent year-over-year, a testament to the team’s focus, consistent execution, and the momentum we're seeing as customers scale agentic automation across the enterprise,” said Daniel Dines, UiPath Founder and Chief Executive Officer.

Company Overview

Starting with robotic process automation (RPA) and evolving into a comprehensive automation powerhouse, UiPath (NYSE:PATH) provides an AI-powered business automation platform that enables organizations to create software robots that mimic human actions to streamline repetitive tasks and processes.

Revenue Growth

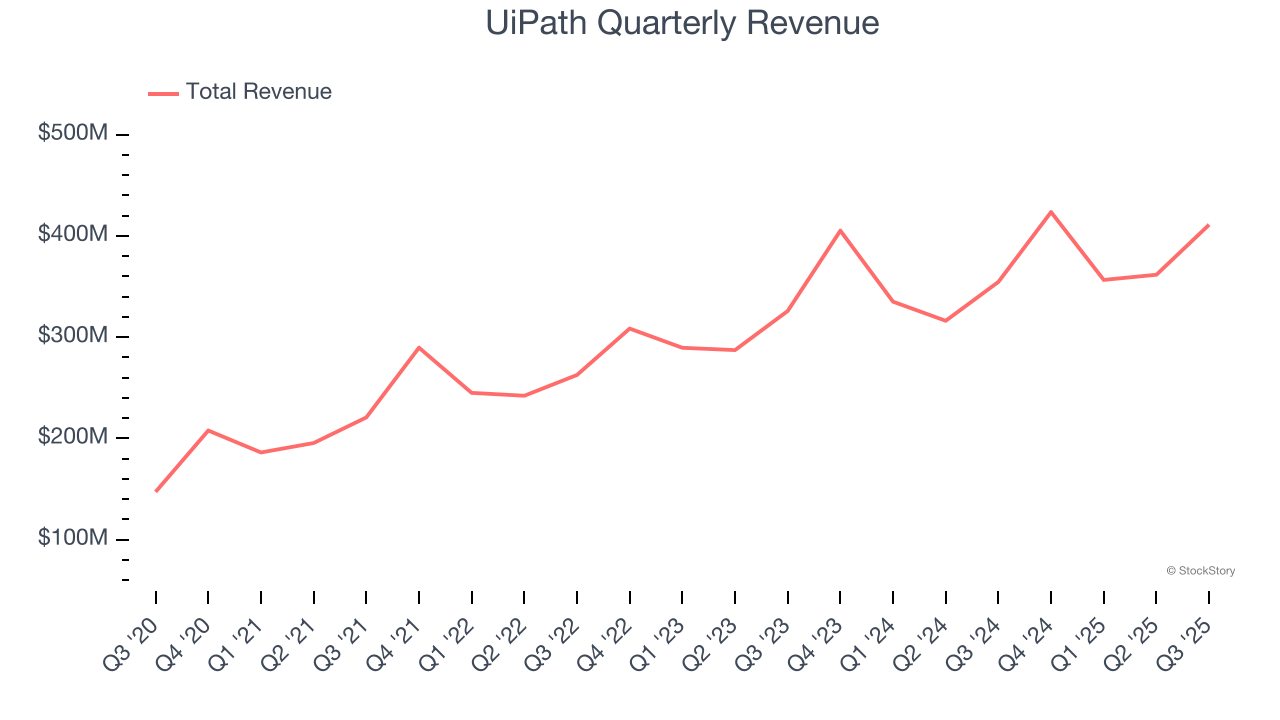

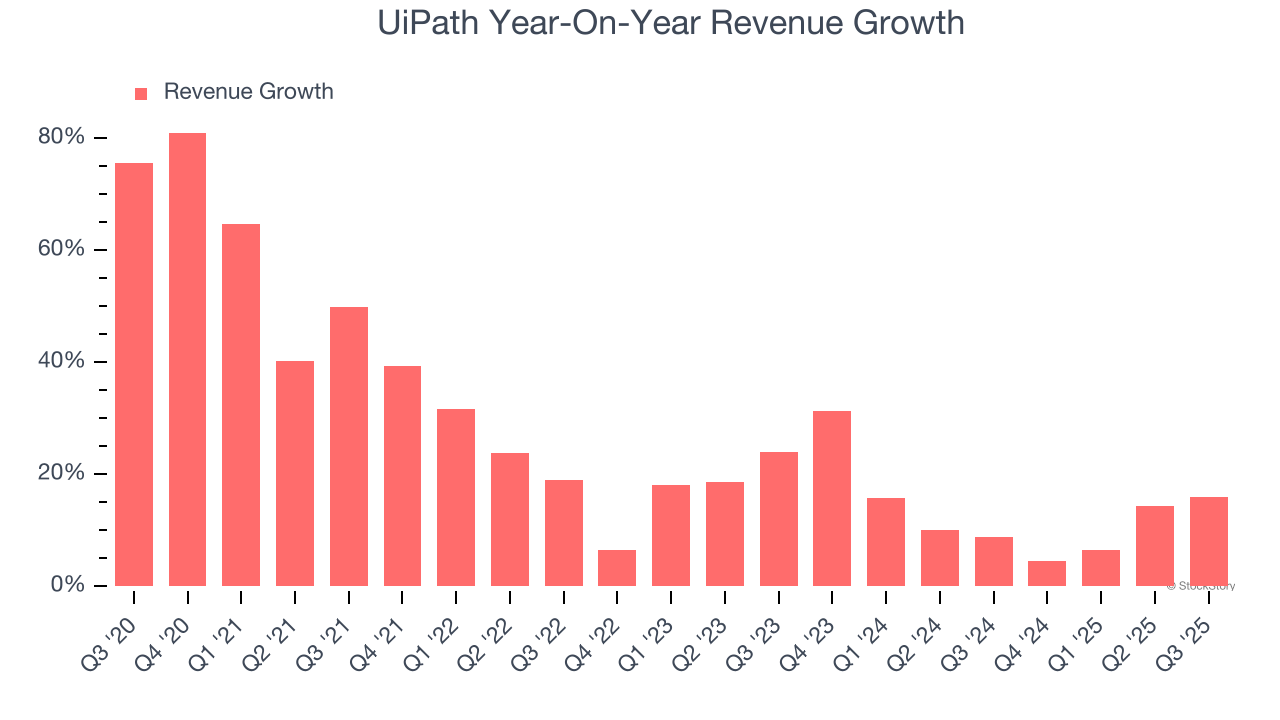

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, UiPath grew its sales at a solid 24.7% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. UiPath’s recent performance shows its demand has slowed as its annualized revenue growth of 13.2% over the last two years was below its five-year trend.

This quarter, UiPath reported year-on-year revenue growth of 15.9%, and its $411.1 million of revenue exceeded Wall Street’s estimates by 4.7%. Company management is currently guiding for a 9.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

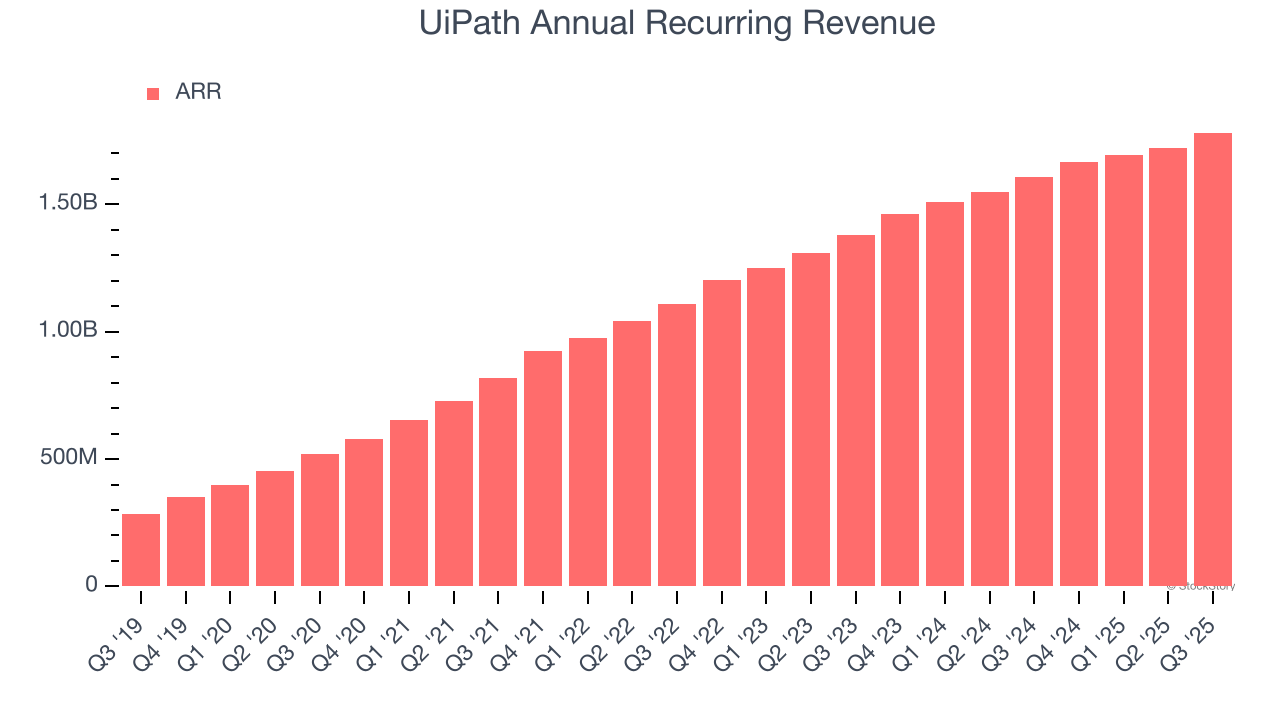

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

UiPath’s ARR came in at $1.78 billion in Q3, and over the last four quarters, its growth was underwhelming as it averaged 12% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

UiPath is quite efficient at acquiring new customers, and its CAC payback period checked in at 31.1 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from UiPath’s Q3 Results

It was encouraging to see UiPath beat analysts’ revenue expectations this quarter. We were also happy its annual recurring revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 7.6% to $16.19 immediately following the results.

UiPath may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.