TaskUs currently trades at $13.28 per share and has shown little upside over the past six months, posting a middling return of 3.6%.

Is there a buying opportunity in TaskUs, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We're swiping left on TaskUs for now. Here are three reasons why TASK doesn't excite us and a stock we'd rather own.

Why Is TaskUs Not Exciting?

Founded in 2008 as a virtual assistant service before evolving into a global digital solutions provider, TaskUs (NASDAQ:TASK) provides outsourced digital services and customer experience solutions to innovative companies, helping them manage content moderation, customer support, and AI operations.

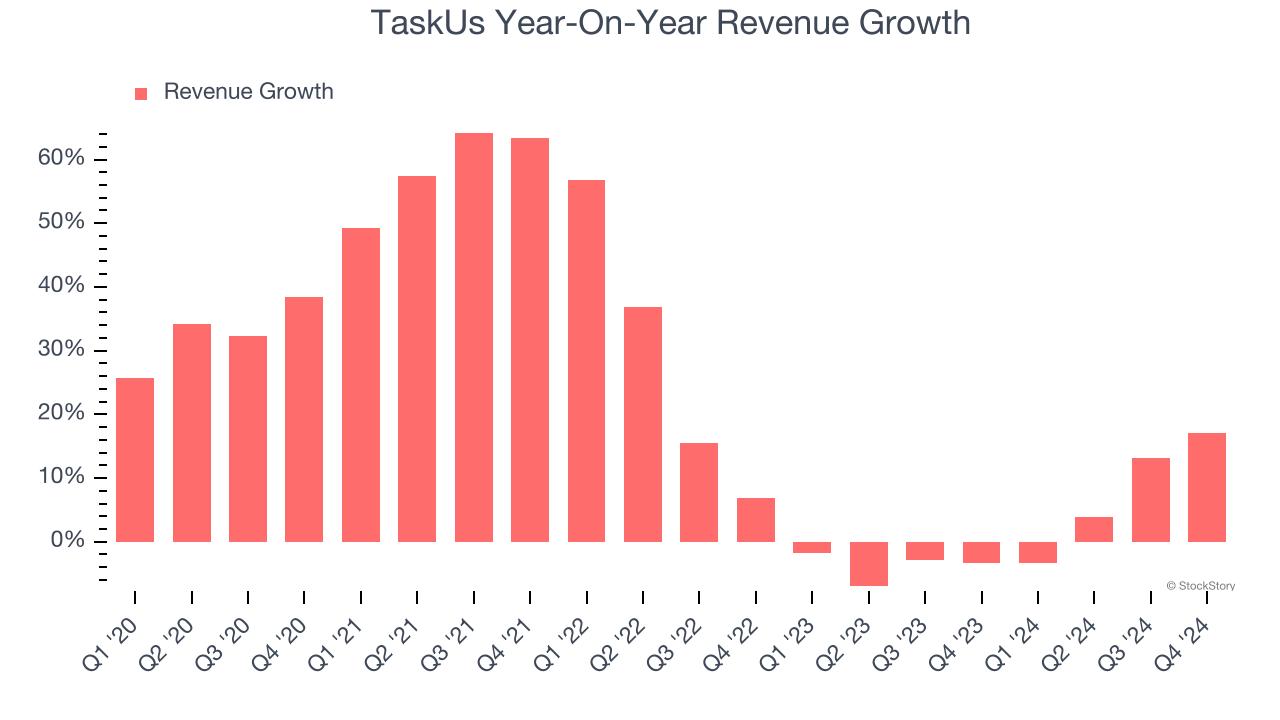

1. Lackluster Revenue Growth

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. TaskUs’s recent history shows its demand has slowed significantly as its annualized revenue growth of 1.8% over the last two years was well below its five-year trend.

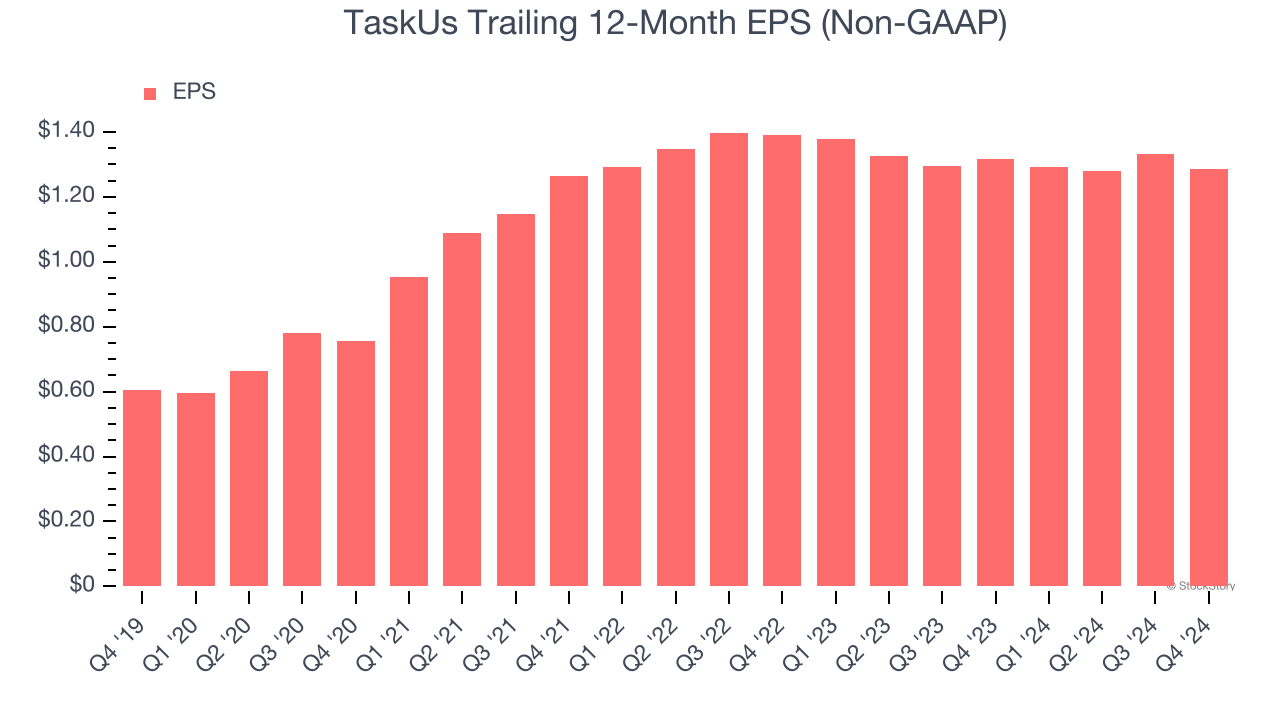

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for TaskUs, its EPS declined by 3.9% annually over the last two years while its revenue grew by 1.8%. This tells us the company became less profitable on a per-share basis as it expanded.

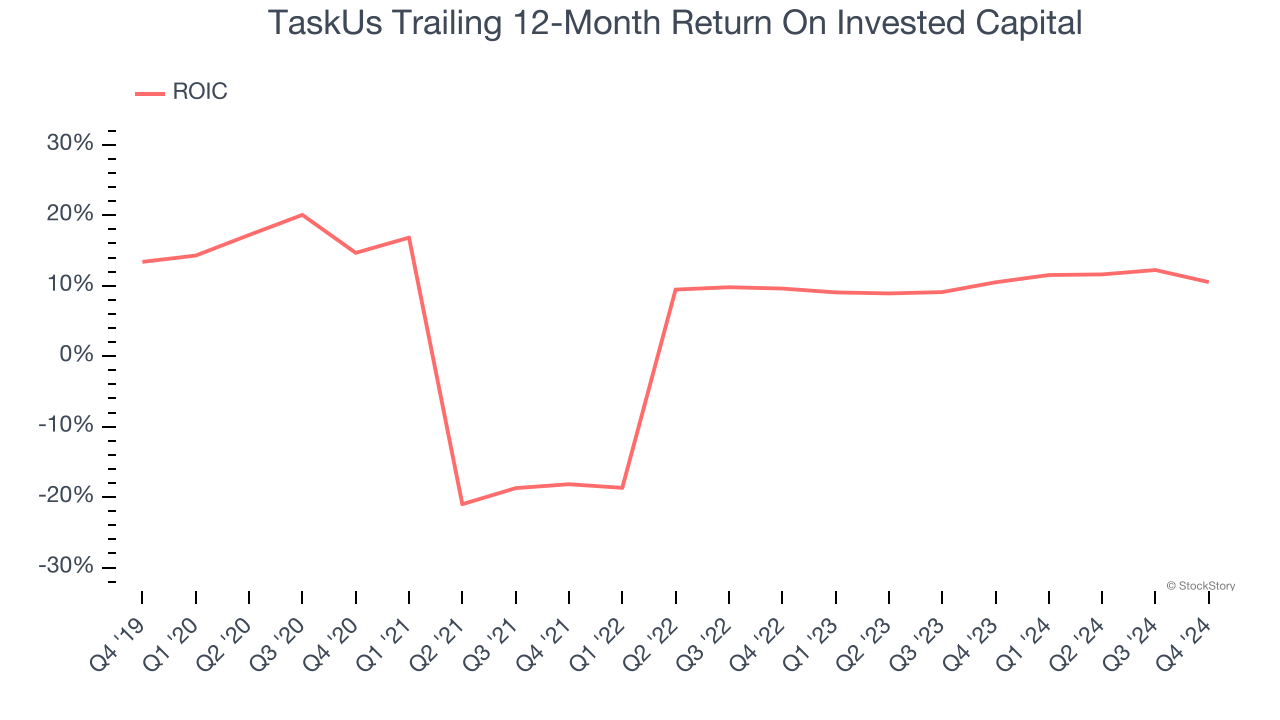

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

TaskUs historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.4%, somewhat low compared to the best business services companies that consistently pump out 25%+.

Final Judgment

TaskUs isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 9.5× forward price-to-earnings (or $13.28 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at one of our top digital advertising picks.

Stocks We Like More Than TaskUs

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.