Shareholders of Bruker would probably like to forget the past six months even happened. The stock has dropped 39.9% and now trades at a new 52-week low of $41.52. This may have investors wondering how to approach the situation.

Is now the time to buy Bruker, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even with the cheaper entry price, we don't have much confidence in Bruker. Here are three reasons why we avoid BRKR and a stock we'd rather own.

Why Is Bruker Not Exciting?

With roots dating back to the pioneering days of nuclear magnetic resonance technology, Bruker (NASDAQ:BRKR) develops and manufactures high-performance scientific instruments that enable researchers and industrial analysts to explore materials at microscopic, molecular, and cellular levels.

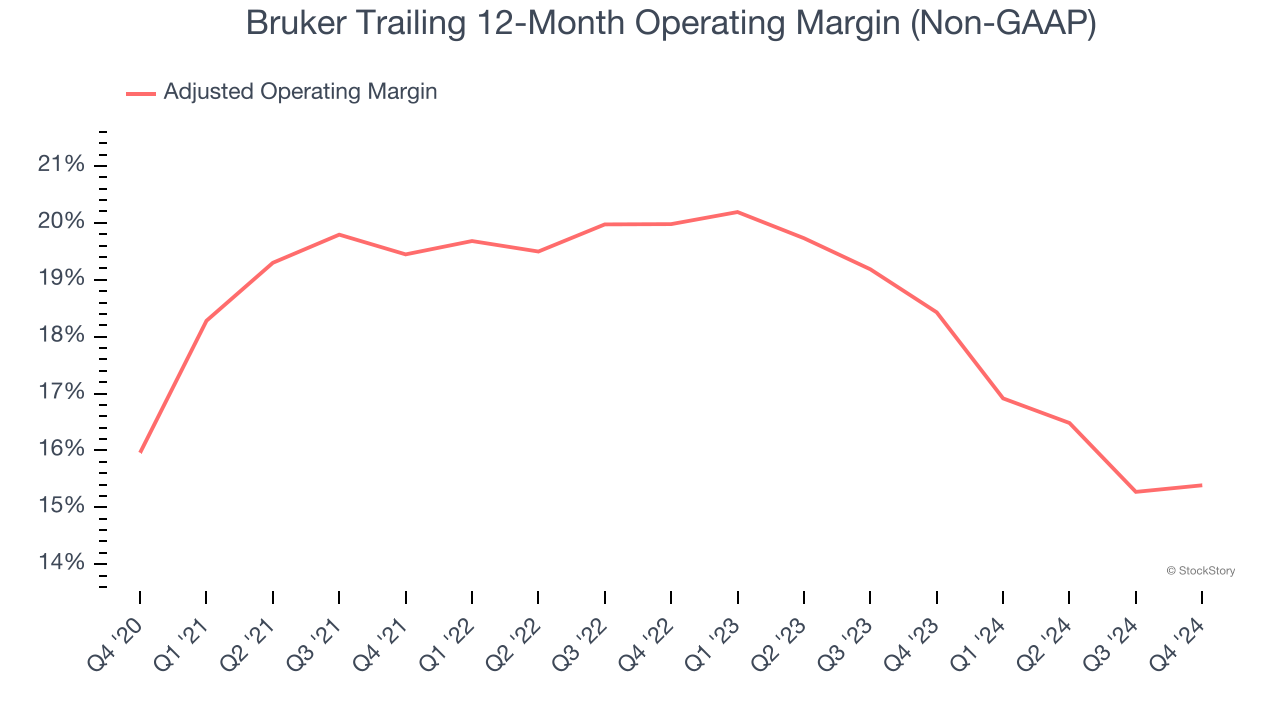

1. Shrinking Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Analyzing the trend in its profitability, Bruker’s adjusted operating margin decreased by 4.6 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 15.4%.

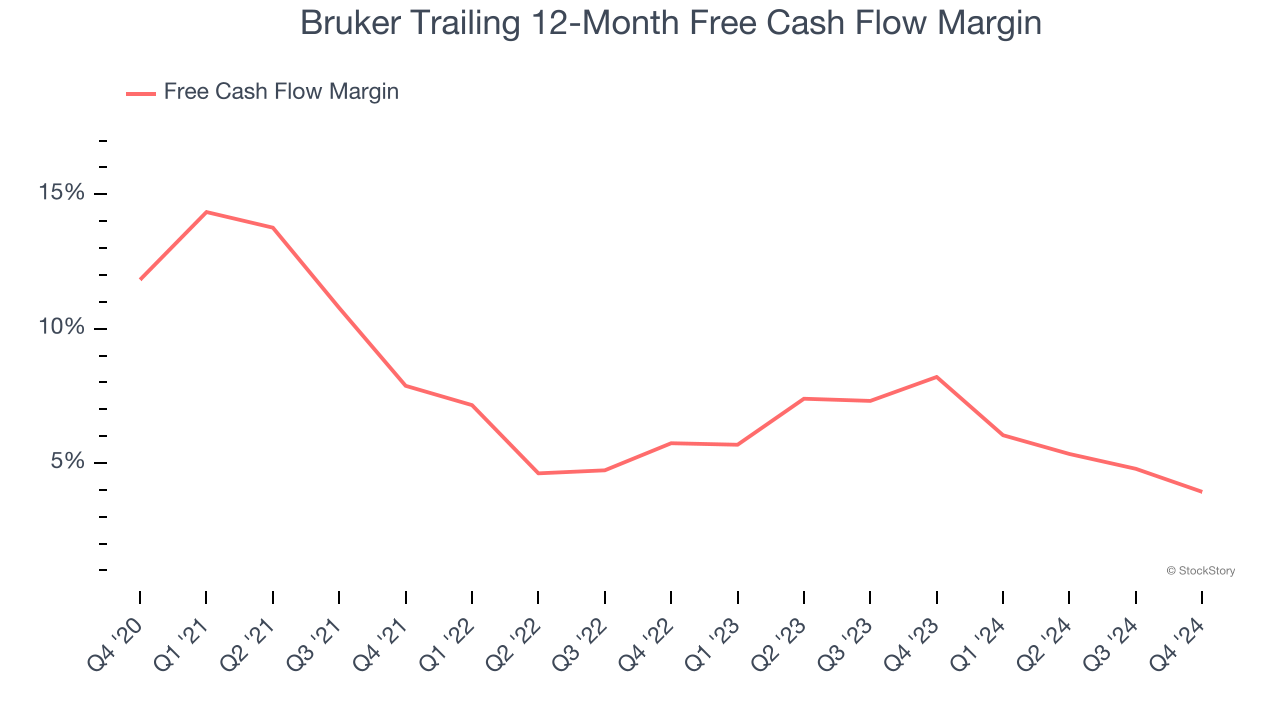

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Bruker’s margin dropped by 7.9 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Bruker’s free cash flow margin for the trailing 12 months was 3.9%.

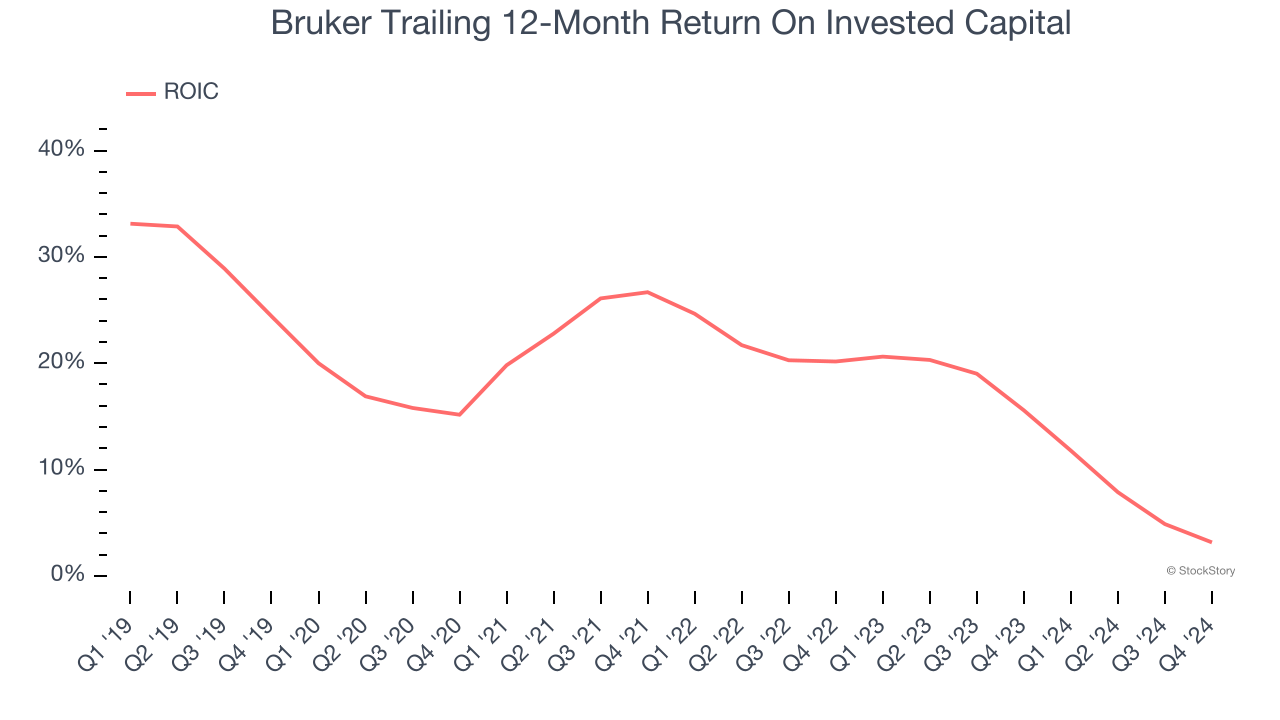

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Bruker’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Bruker isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 15.8× forward price-to-earnings (or $41.52 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Bruker

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.