Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Parker-Hannifin (NYSE:PH) and the best and worst performers in the gas and liquid handling industry.

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 12 gas and liquid handling stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 13% since the latest earnings results.

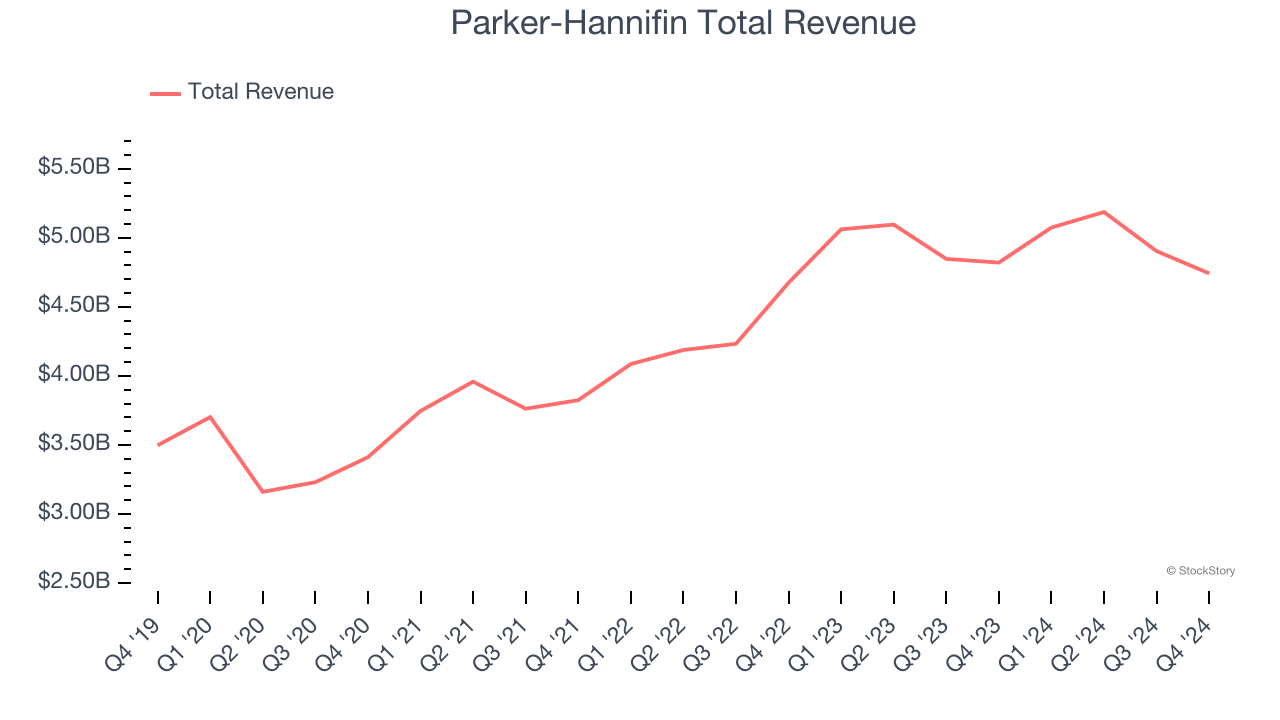

Parker-Hannifin (NYSE:PH)

Founded in 1917, Parker Hannifin (NYSE:PH) is a manufacturer of motion and control systems for a wide variety of mobile, industrial and aerospace markets.

Parker-Hannifin reported revenues of $4.74 billion, down 1.6% year on year. This print fell short of analysts’ expectations by 1.1%. Overall, it was a slower quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

“Our performance this quarter reflects our focus on operational excellence and the strength of our balanced portfolio,” said Jenny Parmentier, Chairman and Chief Executive Officer.

The stock is down 10.7% since reporting and currently trades at $594.

Is now the time to buy Parker-Hannifin? Access our full analysis of the earnings results here, it’s free.

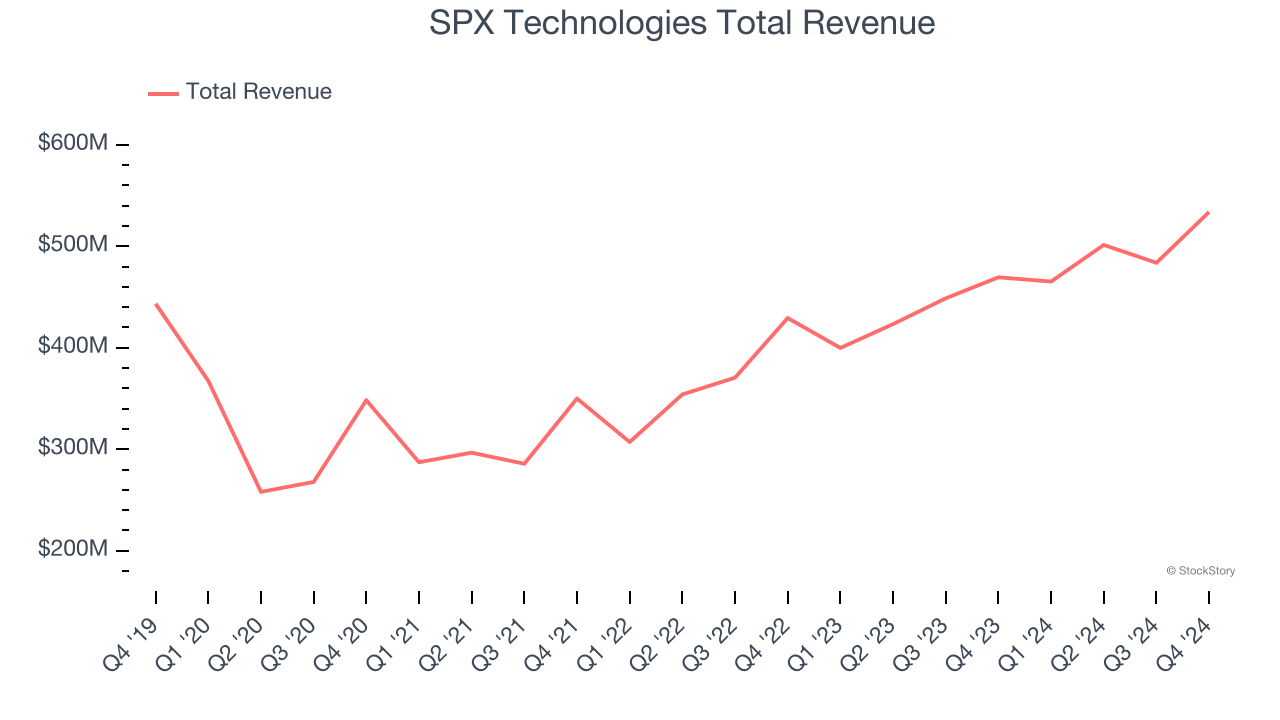

Best Q4: SPX Technologies (NYSE:SPXC)

SPX Technologies (NYSE:SPXC) is an industrial conglomerate catering to the energy, manufacturing, automotive, and aerospace sectors.

SPX Technologies reported revenues of $533.7 million, up 13.7% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ EBITDA and organic revenue estimates.

SPX Technologies delivered the fastest revenue growth among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 6.2% since reporting. It currently trades at $127.93.

Is now the time to buy SPX Technologies? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Graco (NYSE:GGG)

Founded in 1926, Graco (NYSE:GGG) is an industrial company specializing in the development and manufacturing of fluid-handling systems and products.

Graco reported revenues of $548.7 million, down 3.2% year on year, falling short of analysts’ expectations by 1.4%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 3.6% since the results and currently trades at $82.98.

Read our full analysis of Graco’s results here.

Donaldson (NYSE:DCI)

Playing a vital role in the historic Apollo 11 mission, Donaldson (NYSE:DCI) manufacturers and sells filtration equipment for various industries.

Donaldson reported revenues of $870 million, flat year on year. This number missed analysts’ expectations by 4.2%. Overall, it was a softer quarter as it also produced a significant miss of analysts’ constant currency revenue estimates.

The stock is down 4.3% since reporting and currently trades at $66.28.

Read our full, actionable report on Donaldson here, it’s free.

Standex (NYSE:SXI)

Holding over 500 patents globally, Standex (NYSE:SXI) is a manufacturer and distributor of industrial components for various sectors.

Standex reported revenues of $189.8 million, up 6.4% year on year. This result surpassed analysts’ expectations by 0.5%. More broadly, it was a satisfactory quarter as it also recorded a solid beat of analysts’ EPS estimates.

The stock is down 14.5% since reporting and currently trades at $159.36.

Read our full, actionable report on Standex here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.