Industrial fluid and energy systems manufacturer Graham Corporation (NYSE: GHM) announced better-than-expected revenue in Q1 CY2025, with sales up 20.9% year on year to $59.35 million. The company’s full-year revenue guidance of $230 million at the midpoint came in 1.9% above analysts’ estimates. Its GAAP profit of $0.40 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Graham Corporation? Find out by accessing our full research report, it’s free.

Graham Corporation (GHM) Q1 CY2025 Highlights:

- Revenue: $59.35 million vs analyst estimates of $55.67 million (20.9% year-on-year growth, 6.6% beat)

- EPS (GAAP): $0.40 vs analyst estimates of $0.18 (significant beat)

- Adjusted EBITDA: $7.65 million vs analyst estimates of $4.77 million (12.9% margin, 60.5% beat)

- EBITDA guidance for the upcoming financial year 2026 is $25 million at the midpoint, above analyst estimates of $23.77 million

- Operating Margin: 9.3%, up from -3% in the same quarter last year

- Free Cash Flow was -$8.71 million, down from $4.60 million in the same quarter last year

- Backlog: $412.3 million at quarter end

- Market Capitalization: $457.9 million

“We closed fiscal 2025 with strong momentum, as our fourth quarter results reflected solid execution and sustained demand across our diversified product portfolio,” said Daniel J. Thoren, Chief Executive Officer.

Company Overview

Founded when its founder patented a unique design for a vacuum system used in the sugar refining process, Graham (NYSE:GHM) provides vacuum and heat transfer equipment for the energy, petrochemical, refining, and chemical sectors.

Sales Growth

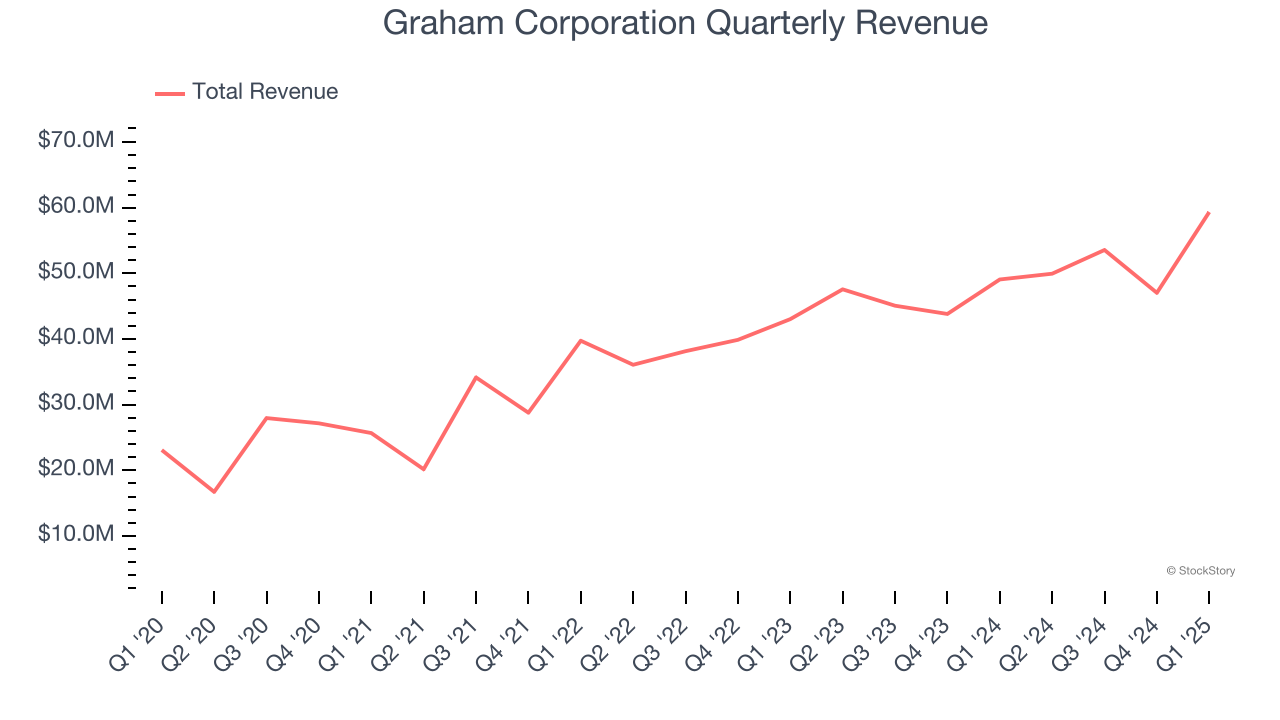

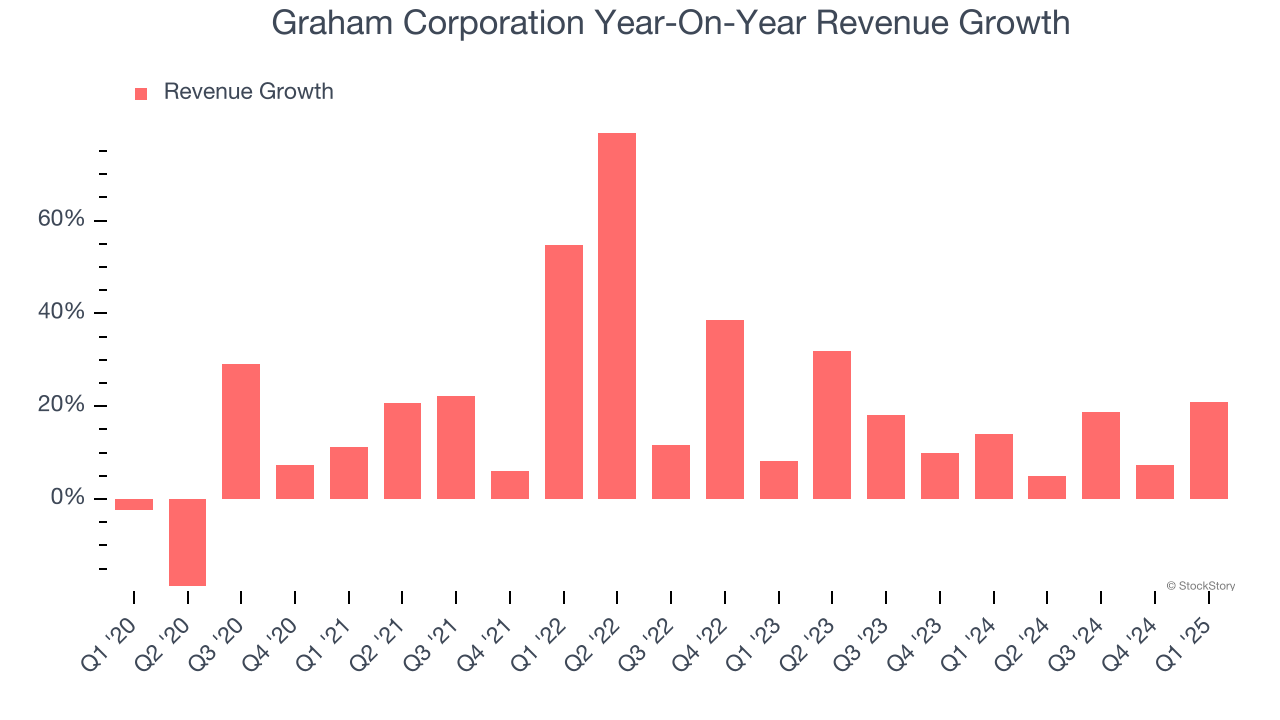

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Graham Corporation’s 18.3% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Graham Corporation’s annualized revenue growth of 15.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Graham Corporation reported robust year-on-year revenue growth of 20.9%, and its $59.35 million of revenue topped Wall Street estimates by 6.6%.

Looking ahead, sell-side analysts expect revenue to grow 7.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

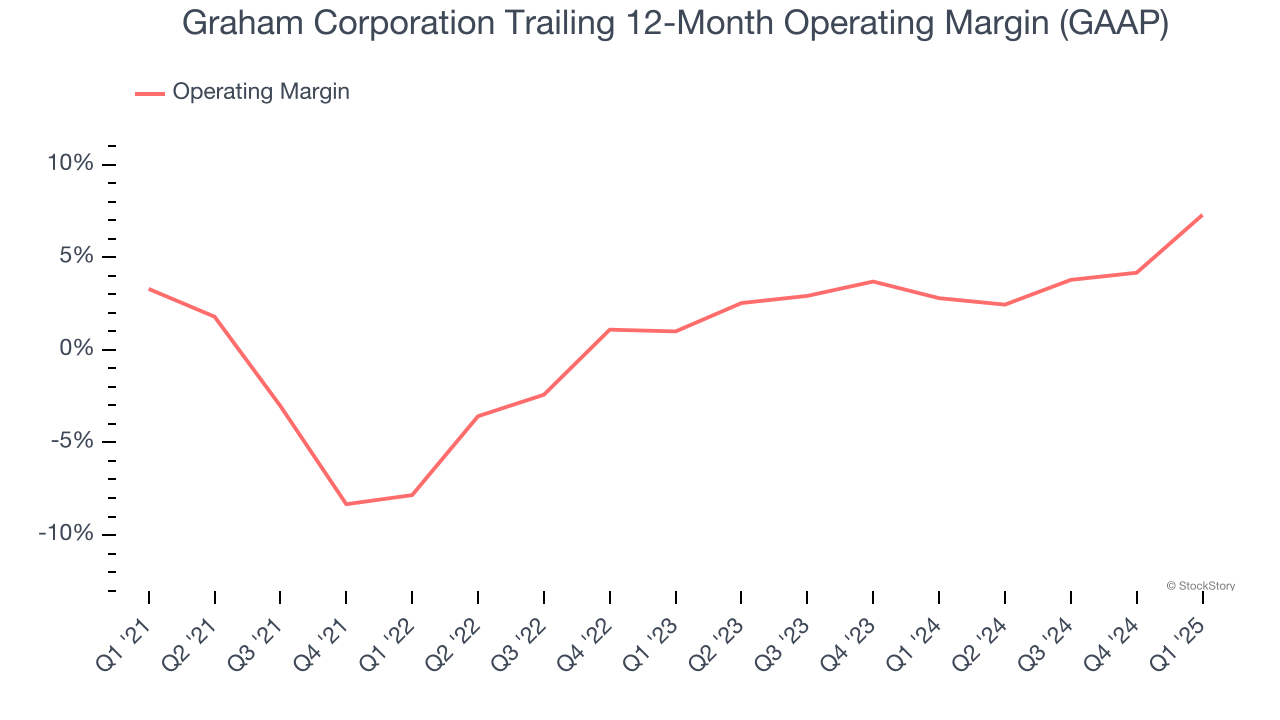

Graham Corporation was profitable over the last five years but held back by its large cost base. Its average operating margin of 2% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Graham Corporation’s operating margin rose by 4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Graham Corporation generated an operating margin profit margin of 9.3%, up 12.3 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

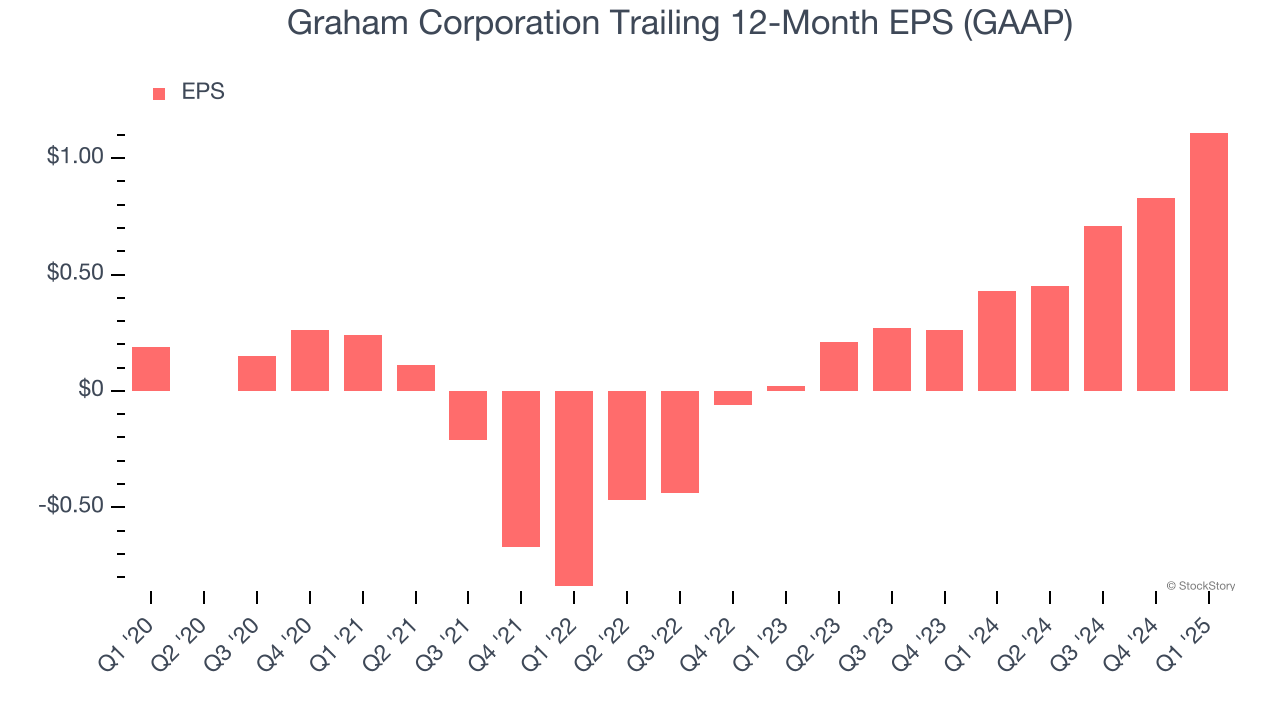

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Graham Corporation’s EPS grew at an astounding 42.3% compounded annual growth rate over the last five years, higher than its 18.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Graham Corporation’s earnings to better understand the drivers of its performance. As we mentioned earlier, Graham Corporation’s operating margin expanded by 4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Graham Corporation, its two-year annual EPS growth of 645% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q1, Graham Corporation reported EPS at $0.40, up from $0.12 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Graham Corporation’s full-year EPS of $1.11 to shrink by 10.4%.

Key Takeaways from Graham Corporation’s Q1 Results

We were impressed by how significantly Graham Corporation blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also excited its full-year EBITDA guidance outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 13% to $47.50 immediately following the results.

Sure, Graham Corporation had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.