As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at traditional fast food stocks, starting with Jack in the Box (NASDAQ:JACK).

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 14 traditional fast food stocks we track reported a slower Q1. As a group, revenues missed analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 2% on average since the latest earnings results.

Jack in the Box (NASDAQ:JACK)

Delighting customers since its inception in 1951, Jack in the Box (NASDAQ:JACK) is a distinctive fast-food chain known for its bold flavors, innovative menu items, and quirky marketing.

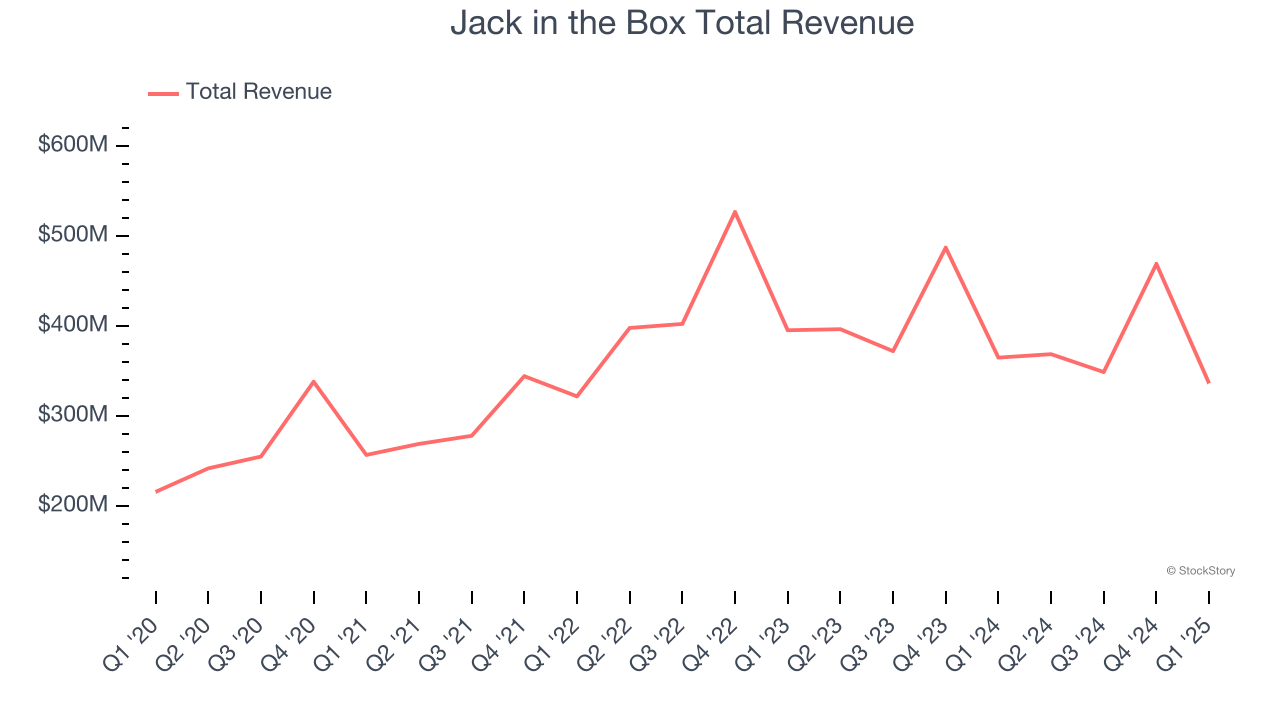

Jack in the Box reported revenues of $336.7 million, down 7.8% year on year. This print fell short of analysts’ expectations by 1.4%. Overall, it was a slower quarter for the company with a slight miss of analysts’ same-store sales estimates.

“I am encouraged by our marketing plans in the back half of 2025, which we expect to energize sales despite the difficult industry-wide macro environment in which we continue to operate,” said Lance Tucker, Jack in the Box Chief Executive Officer.

The stock is down 21% since reporting and currently trades at $20.28.

Read our full report on Jack in the Box here, it’s free.

Best Q1: Dutch Bros (NYSE:BROS)

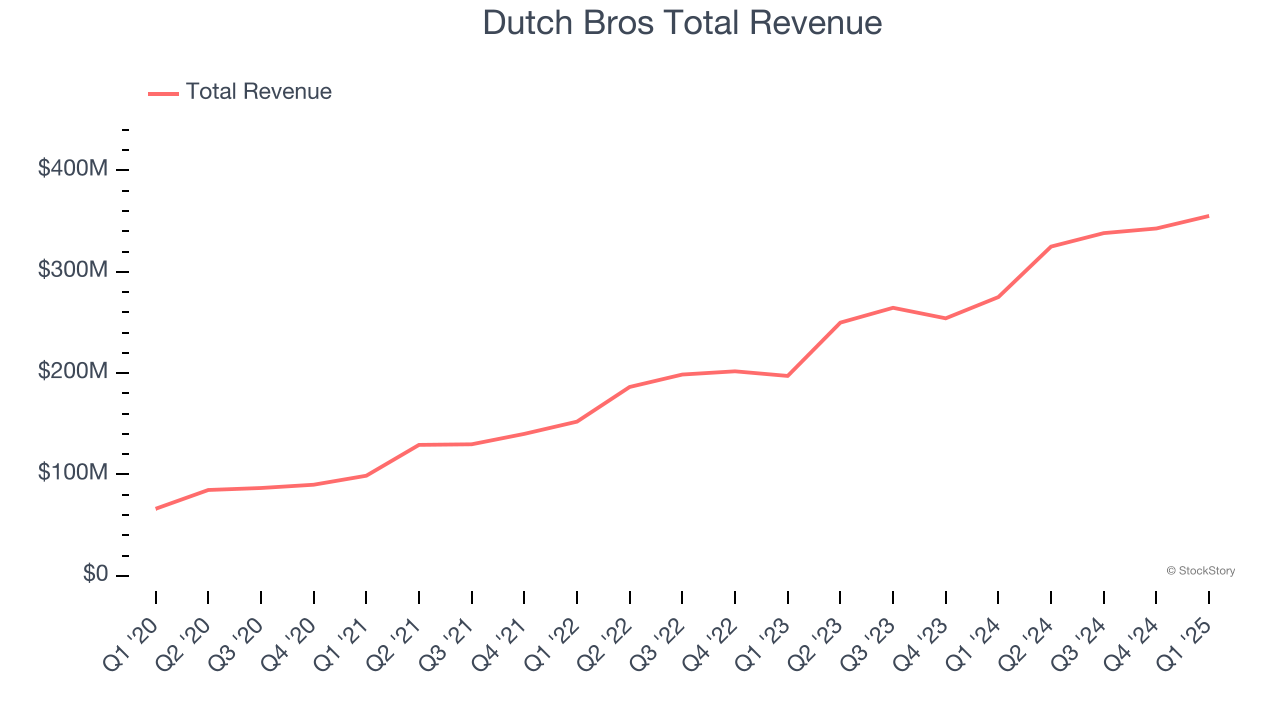

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Dutch Bros reported revenues of $355.2 million, up 29.1% year on year, outperforming analysts’ expectations by 3%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ EPS estimates.

Dutch Bros achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 23.9% since reporting. It currently trades at $73.22.

Is now the time to buy Dutch Bros? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Arcos Dorados (NYSE:ARCO)

Translating to “Golden Arches” in Spanish, Arcos Dorados (NYSE:ARCO) is the master franchisee of the McDonald's brand in Latin America and the Caribbean, responsible for its operations and growth in over 20 countries.

Arcos Dorados reported revenues of $1.08 billion, flat year on year, falling short of analysts’ expectations by 3.6%. It was a disappointing quarter as it posted a significant miss of analysts’ same-store sales and EPS estimates.

As expected, the stock is down 7.7% since the results and currently trades at $7.53.

Read our full analysis of Arcos Dorados’s results here.

Restaurant Brands (NYSE:QSR)

Formed through a strategic merger, Restaurant Brands International (NYSE:QSR) is a multinational corporation that owns three iconic fast-food chains: Burger King, Tim Hortons, and Popeyes.

Restaurant Brands reported revenues of $2.11 billion, up 21.3% year on year. This number missed analysts’ expectations by 1.8%. It was a softer quarter as it also logged a miss of analysts’ EBITDA and same-store sales estimates.

The stock is up 4.6% since reporting and currently trades at $71.

Read our full, actionable report on Restaurant Brands here, it’s free.

Wendy's (NASDAQ:WEN)

Founded by Dave Thomas in 1969, Wendy’s (NASDAQ:WEN) is a renowned fast-food chain known for its fresh, never-frozen beef burgers, flavorful menu options, and commitment to quality.

Wendy's reported revenues of $523.5 million, down 2.1% year on year. This print was in line with analysts’ expectations. More broadly, it was a slower quarter as it recorded full-year EPS guidance missing analysts’ expectations.

The stock is down 6.2% since reporting and currently trades at $11.72.

Read our full, actionable report on Wendy's here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.