Pinnacle Financial Partners has gotten torched over the last six months - since February 2025, its stock price has dropped 27.1% to $89.92 per share. This may have investors wondering how to approach the situation.

Following the drawdown, is now a good time to buy PNFP? Find out in our full research report, it’s free.

Why Does Pinnacle Financial Partners Spark Debate?

Founded in 2000 with a focus on delivering big-bank capabilities with community bank personalization, Pinnacle Financial Partners (NASDAQ:PNFP) is a Tennessee-based financial holding company that provides banking, investment, trust, mortgage, and insurance services to businesses and individuals.

Two Positive Attributes:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

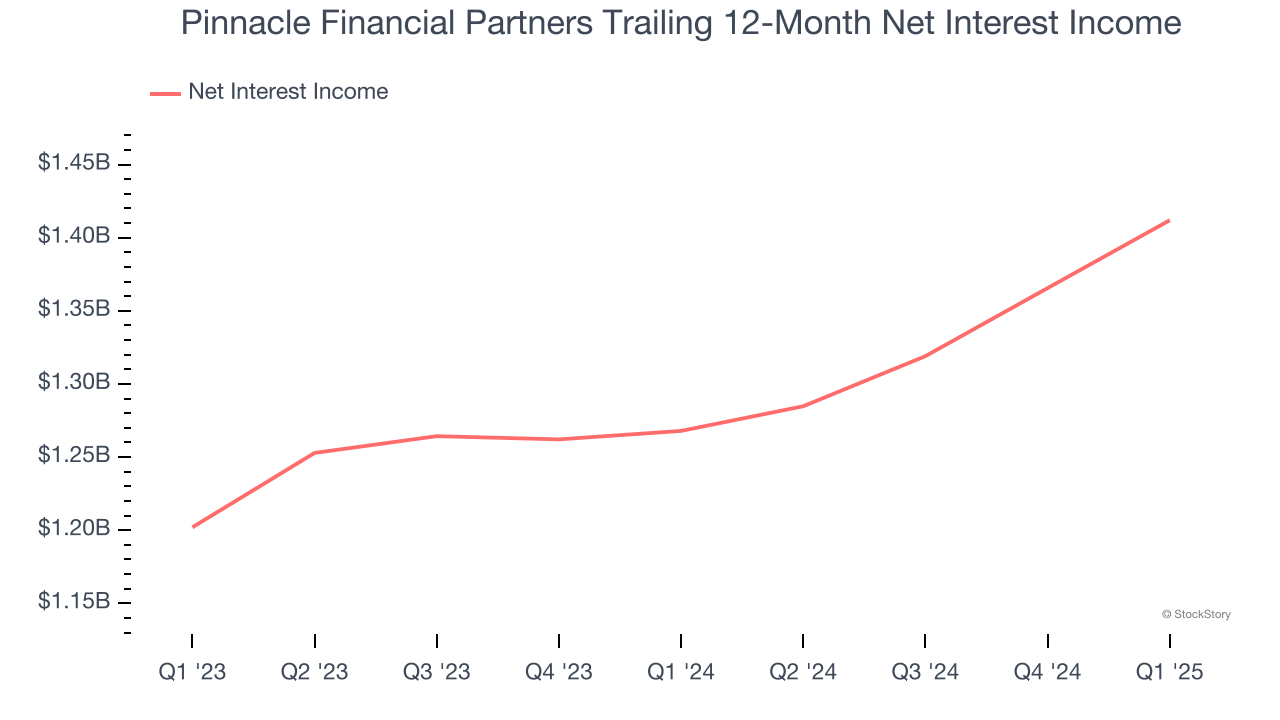

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

Pinnacle Financial Partners’s net interest income has grown at a 13.5% annualized rate over the last four years, better than the broader bank industry.

2. Forecasted Efficiency Ratio Shows Stronger Profits Ahead

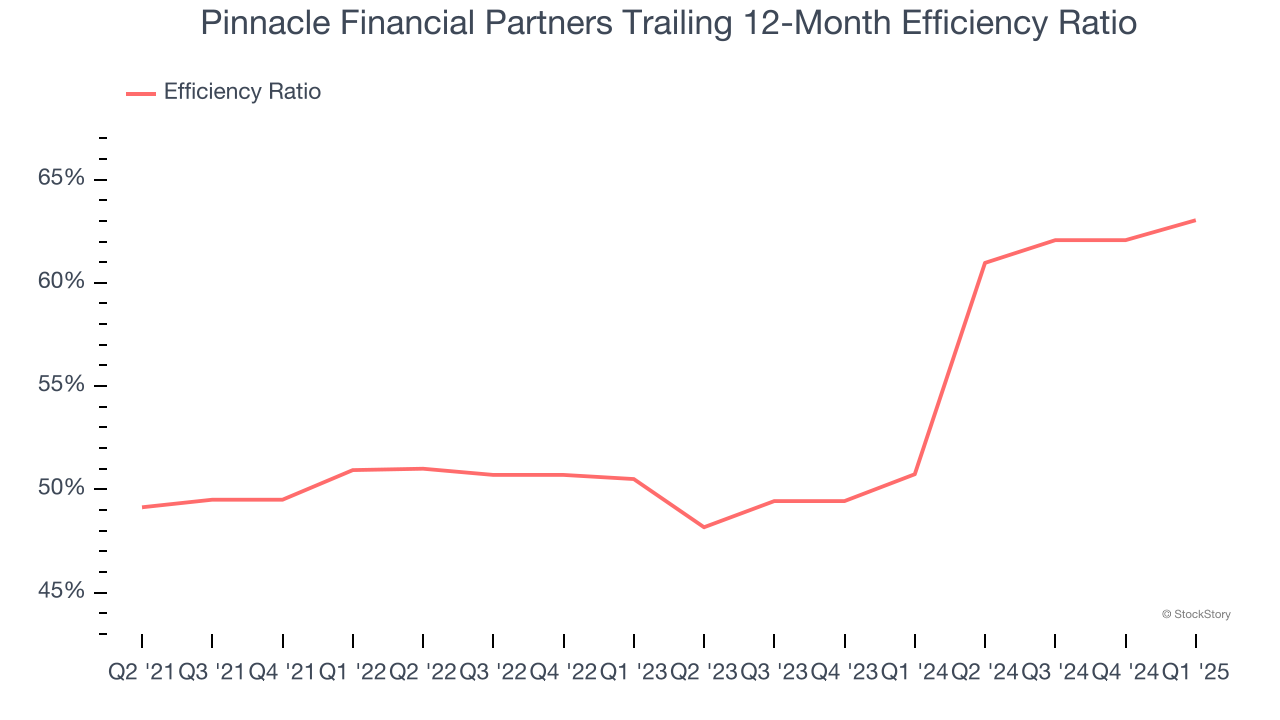

Topline growth alone doesn't tell the complete story - the profitability of that growth shapes actual earnings impact. Banks track this dynamic through efficiency ratios, which compare non-interest expenses such as personnel, rent, IT, and marketing costs to total revenue streams.

Investors focus on efficiency ratio changes rather than absolute levels, understanding that expense structures vary by revenue mix. Counterintuitively, lower efficiency ratios indicate better performance since they represent lower costs relative to revenue.

For the next 12 months, Wall Street expects Pinnacle Financial Partners to rein in some of its expenses as it anticipates an efficiency ratio of 56% compared to 63% over the past year.

One Reason to be Careful:

Lackluster Revenue Growth

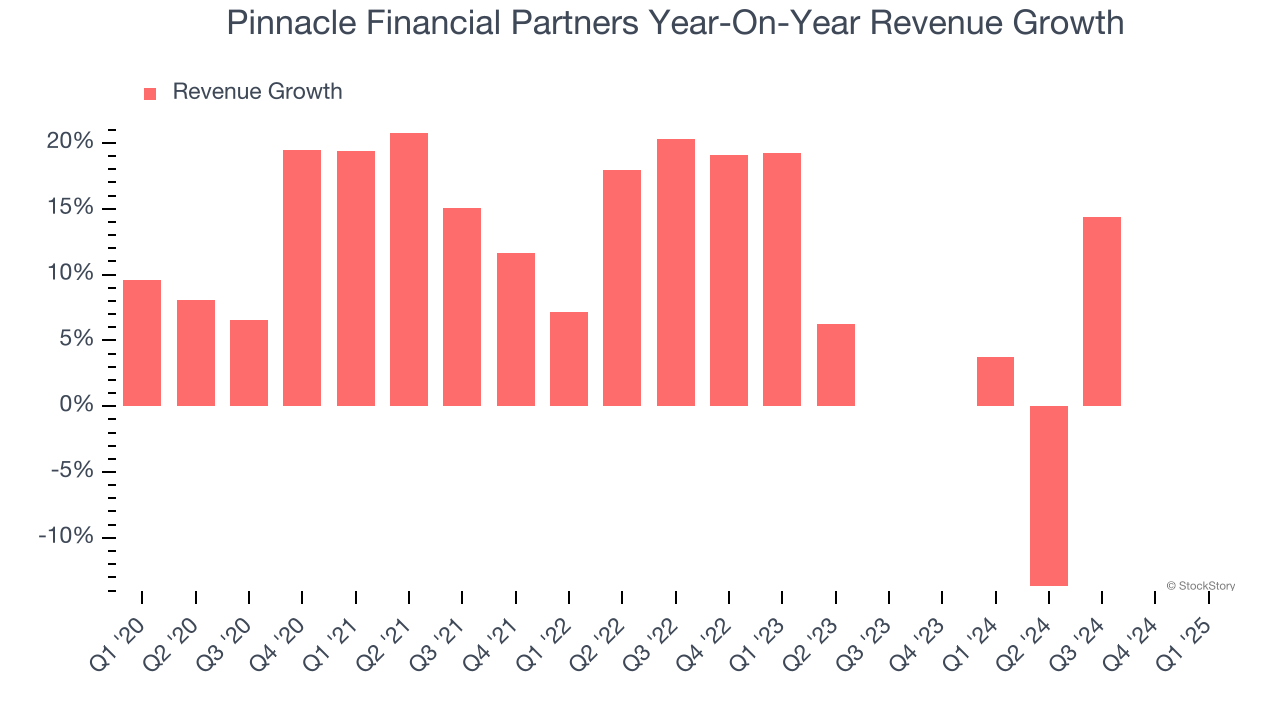

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Pinnacle Financial Partners’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 4.4% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Final Judgment

Pinnacle Financial Partners has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 1× forward P/B (or $89.92 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Pinnacle Financial Partners

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.