Since February 2025, BancFirst has been in a holding pattern, posting a small loss of 0.7% while floating around $121.68. The stock also fell short of the S&P 500’s 5.3% gain during that period.

Is now the time to buy BANF? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free.

Why Does BancFirst Spark Debate?

Operating as a "super community bank" with a decentralized management approach that emphasizes local responsiveness, BancFirst Corporation (NASDAQ:BANF) operates as a financial holding company providing commercial banking services to retail customers and small to medium-sized businesses primarily in Oklahoma and Texas.

Two Positive Attributes:

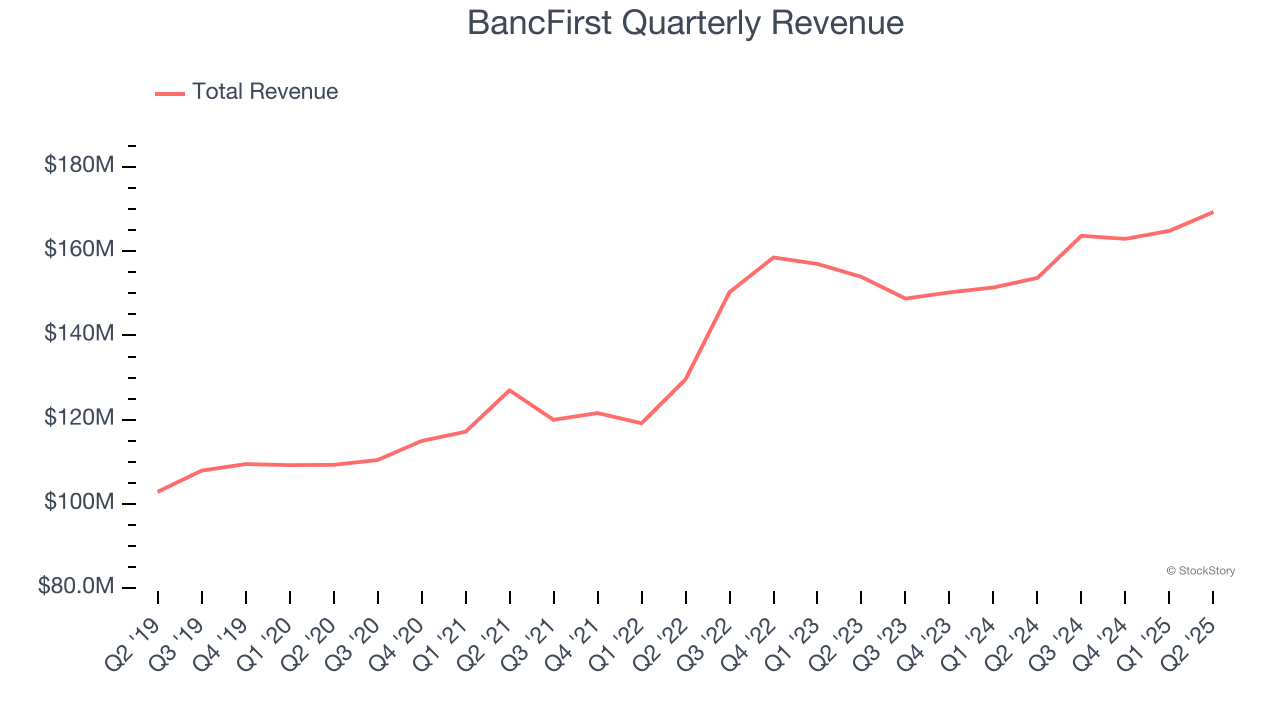

1. Long-Term Revenue Growth Shows Strong Momentum

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

Thankfully, BancFirst’s 8.7% annualized revenue growth over the last five years was solid. Its growth surpassed the average bank company and shows its offerings resonate with customers.

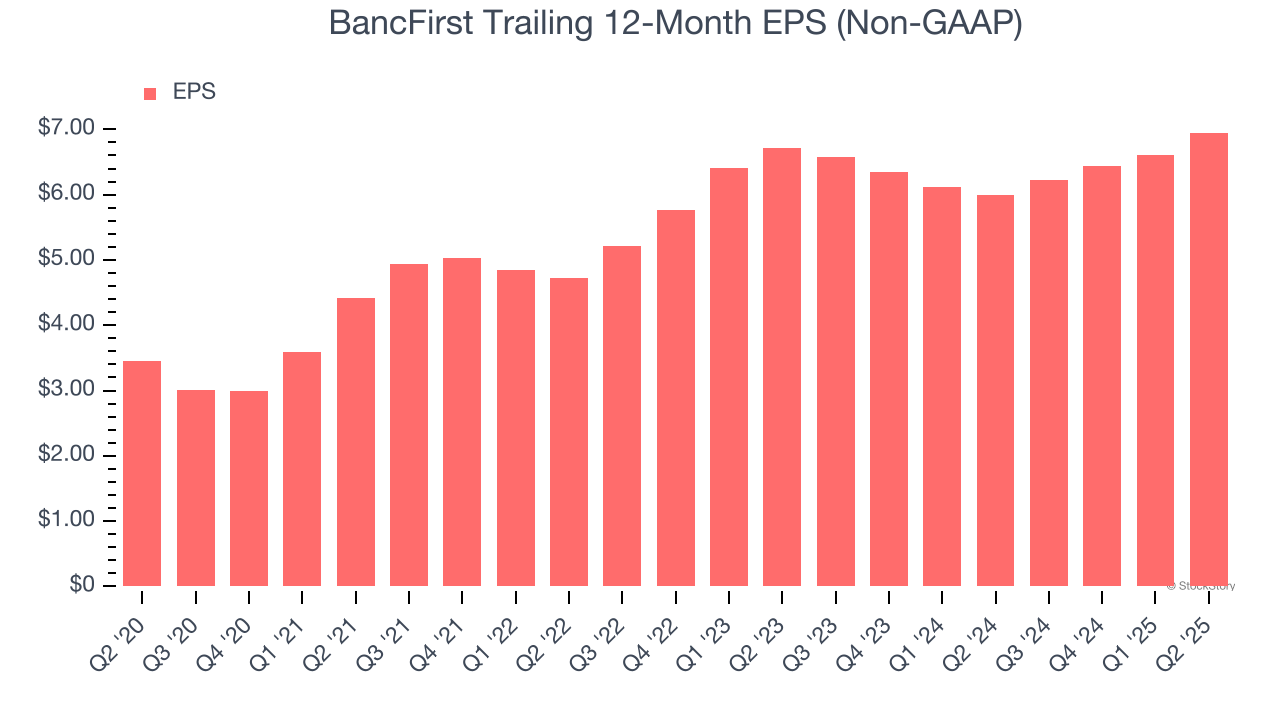

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

BancFirst’s EPS grew at an astounding 15% compounded annual growth rate over the last five years, higher than its 8.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect BancFirst’s net interest income to rise by 4.2%, close to its 4.8% annualized growth for the past two years.

Final Judgment

BancFirst’s positive characteristics outweigh the negatives. With its shares trailing the market in recent months, the stock trades at 2.2× forward P/B (or $121.68 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.