Ross Stores currently trades at $145.25 per share and has shown little upside over the past six months, posting a middling return of 2.8%.

Does this present a buying opportunity for ROST? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does Ross Stores Spark Debate?

Selling excess inventory or overstocked items from other retailers, Ross Stores (NASDAQ:ROST) is an off-price concept that sells apparel and other goods at prices much lower than department stores.

Two Positive Attributes:

1. Store Growth Signals an Offensive Strategy

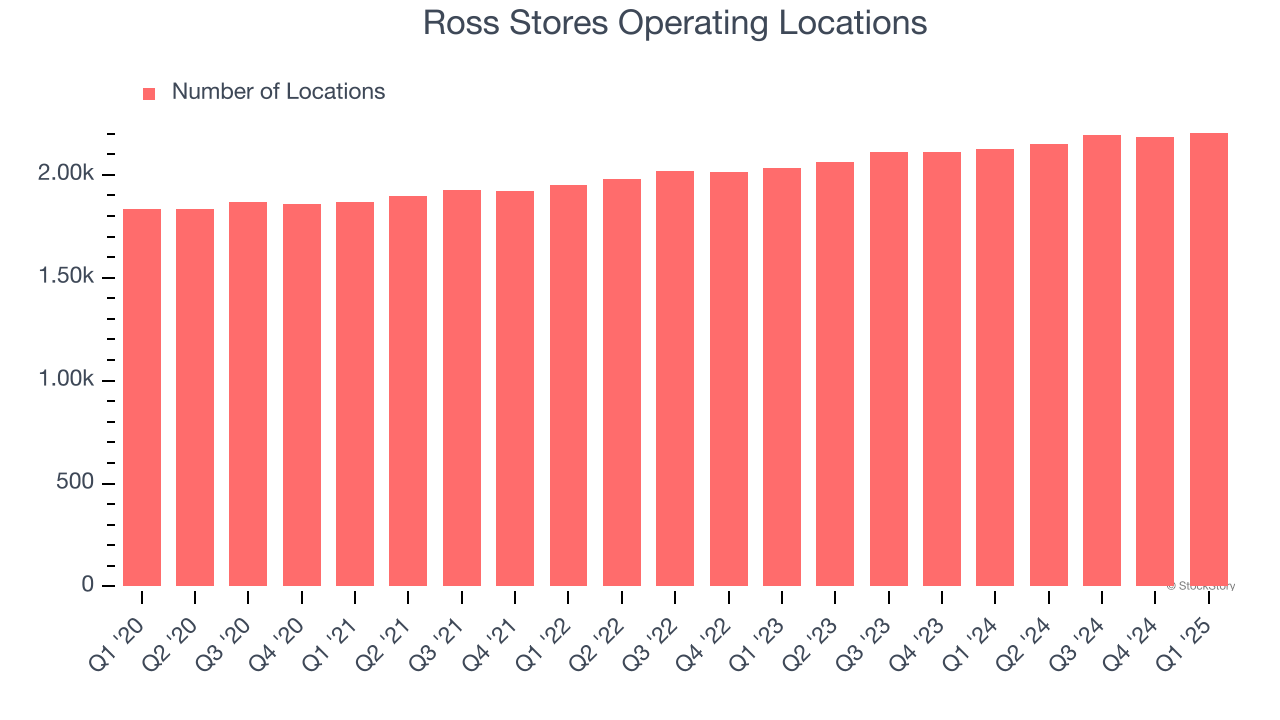

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Ross Stores sported 2,205 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 4.2% annual growth, among the fastest in the consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

2. Surging Same-Store Sales Show Increasing Demand

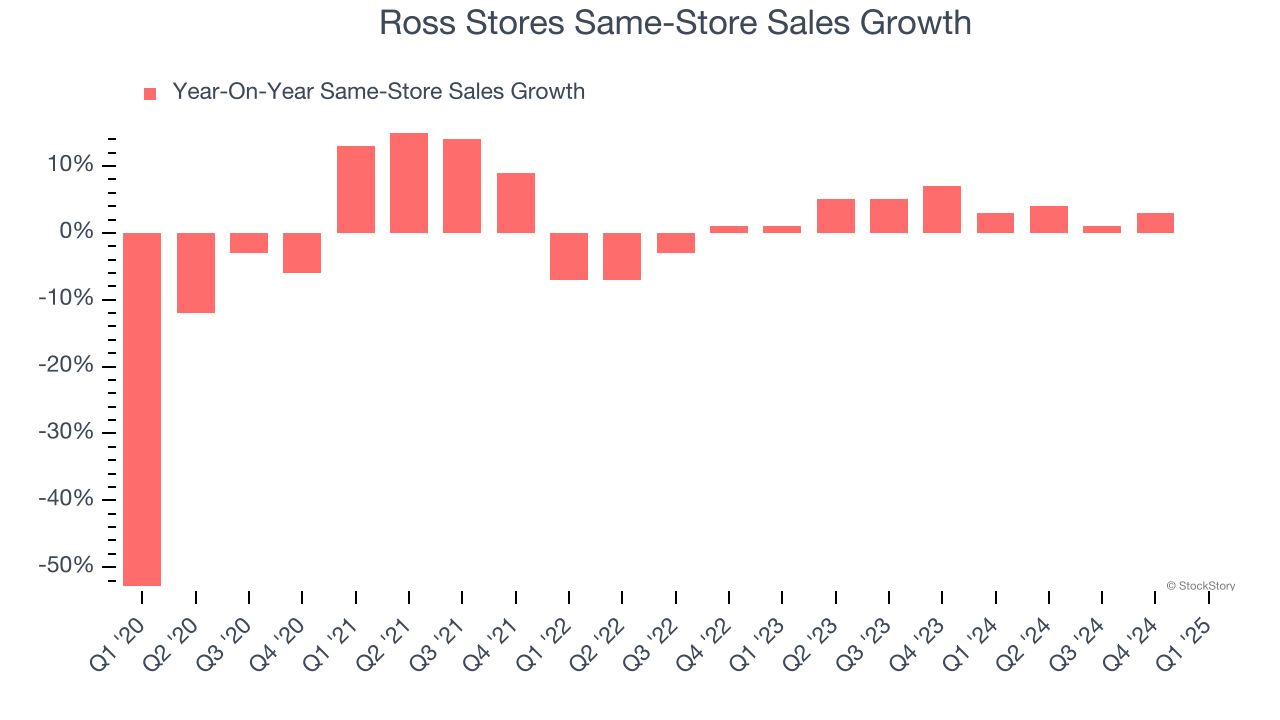

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Ross Stores’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.5% per year.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

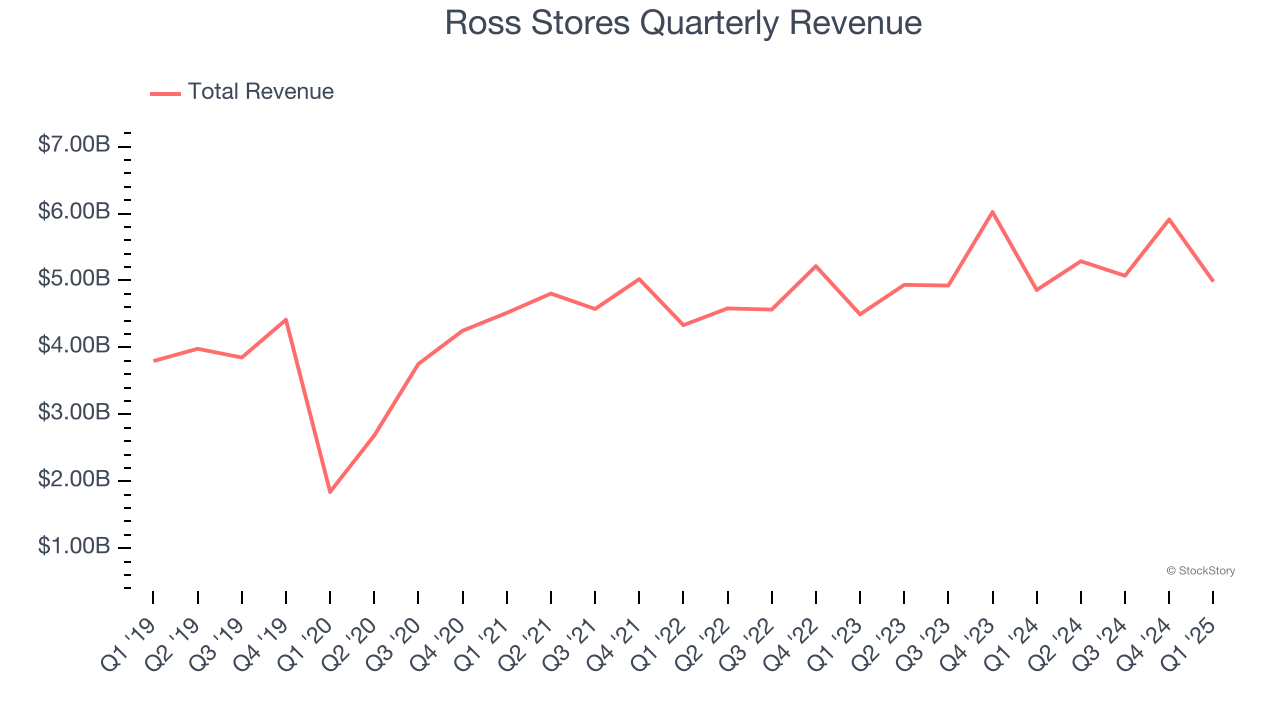

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Ross Stores’s 5.8% annualized revenue growth over the last six years was tepid. This wasn’t a great result compared to the rest of the consumer retail sector, but there are still things to like about Ross Stores.

Final Judgment

Ross Stores has huge potential even though it has some open questions, but at $145.25 per share (or 22.1× forward P/E), is now the right time to buy the stock? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.