Video sharing platform Rumble (NASDAQGM:RUM) missed Wall Street’s revenue expectations in Q2 CY2025, but sales rose 11.6% year on year to $25.08 million. Its GAAP loss of $0.12 per share was 80% below analysts’ consensus estimates.

Is now the time to buy Rumble? Find out by accessing our full research report, it’s free.

Rumble (RUM) Q2 CY2025 Highlights:

- Revenue: $25.08 million vs analyst estimates of $26.78 million (11.6% year-on-year growth, 6.3% miss)

- EPS (GAAP): -$0.12 vs analyst expectations of -$0.07 (80% miss)

- Adjusted EBITDA: -$20.46 million vs analyst estimates of -$11.85 million (-81.6% margin, 72.7% miss)

- Operating Margin: -106%, up from -173% in the same quarter last year

- Free Cash Flow was $2.99 million, up from -$23.1 million in the same quarter last year

- Market Capitalization: $2.67 billion

Rumble's Chairman and CEO, Chris Pavlovski, commented, “With the incredible backing of Tether and the resources now at our disposal, Rumble is entering a new phase of aggressive growth. We’ve always been ambitious, but today we’re in a different position: pursuing bold initiatives to not only compete with, but surpass, big tech peers. In the second quarter, we proved the stickiness of our platform with 51 million MAUs, delivered double-digit revenue growth, and built momentum through strategic partnerships with leaders like Cumulus Media, and MoonPay, as well as a top AI innovator in Q3. With the upcoming launch of Rumble Wallet and our expanding cloud and AI initiatives, we are laying the foundation for sustained growth while protecting a free and open internet.”

Company Overview

Founded in 2013 as a champion for content creator rights and free expression, Rumble (NASDAQ:RUM) is a video sharing platform that positions itself as a free speech alternative to mainstream platforms, offering creators more favorable revenue-sharing opportunities.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $104.1 million in revenue over the past 12 months, Rumble is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

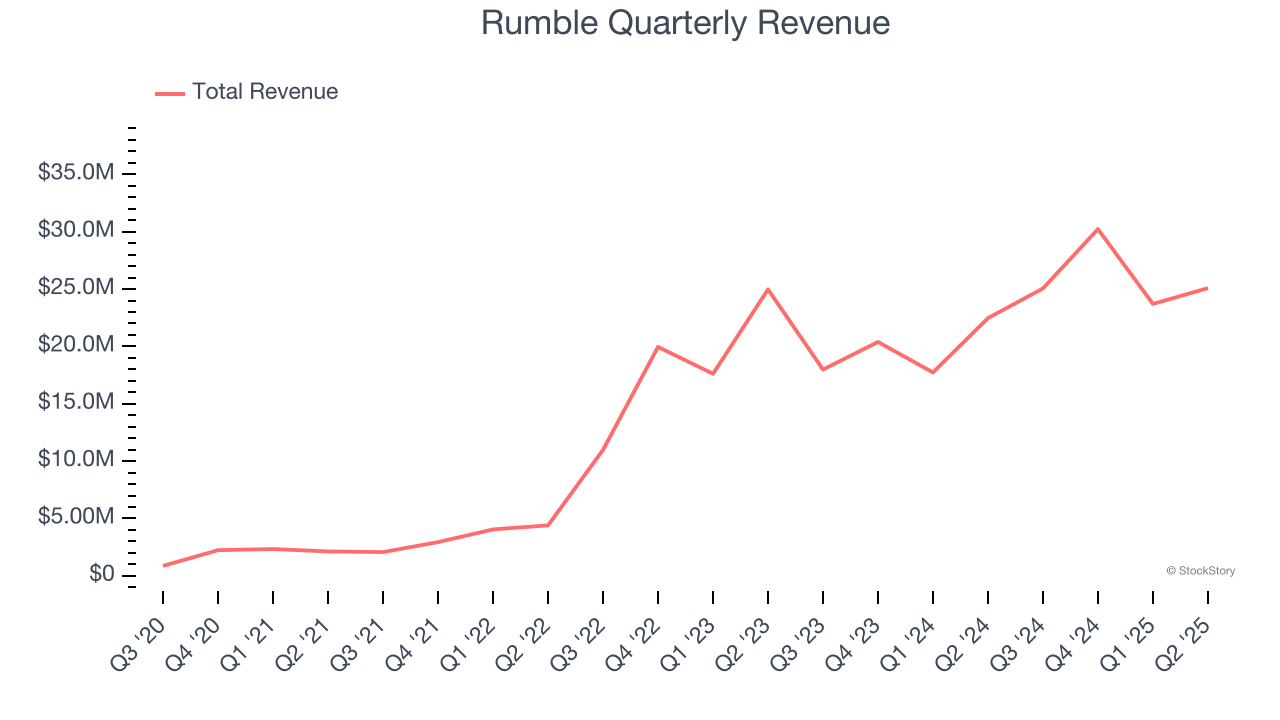

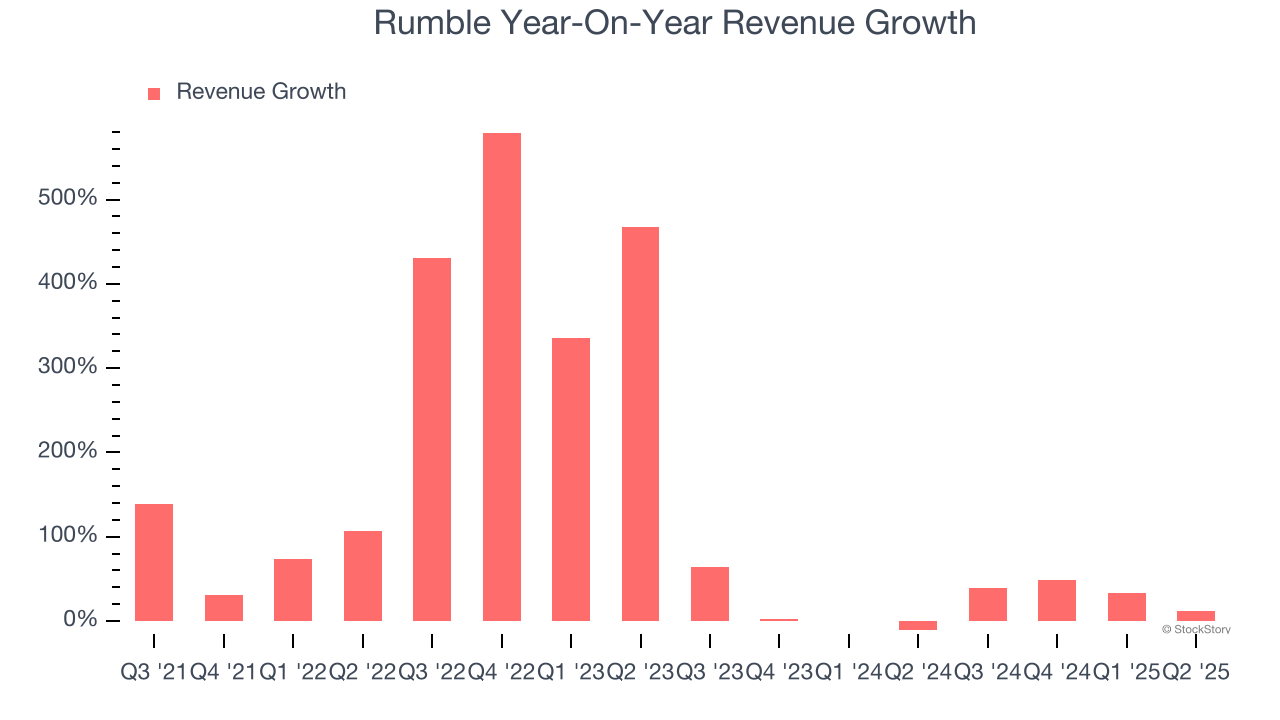

As you can see below, Rumble’s sales grew at an incredible 92.6% compounded annual growth rate over the last four years. This is an encouraging starting point for our analysis because it shows Rumble’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Rumble’s annualized revenue growth of 19% over the last two years is below its four-year trend, but we still think the results suggest healthy demand.

This quarter, Rumble’s revenue grew by 11.6% year on year to $25.08 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 12.6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and suggests the market sees success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

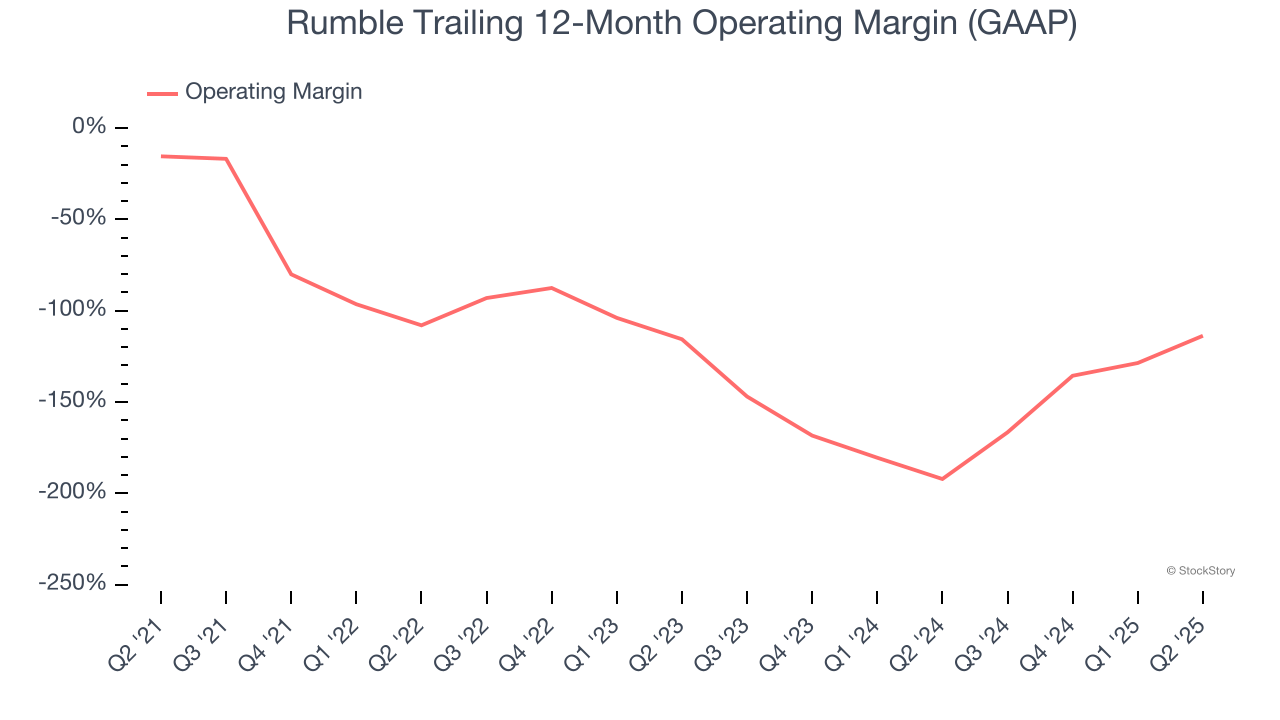

Rumble’s high expenses have contributed to an average operating margin of negative 134% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

Analyzing the trend in its profitability, Rumble’s operating margin decreased by 98.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Rumble’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

Rumble’s operating margin was negative 106% this quarter.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

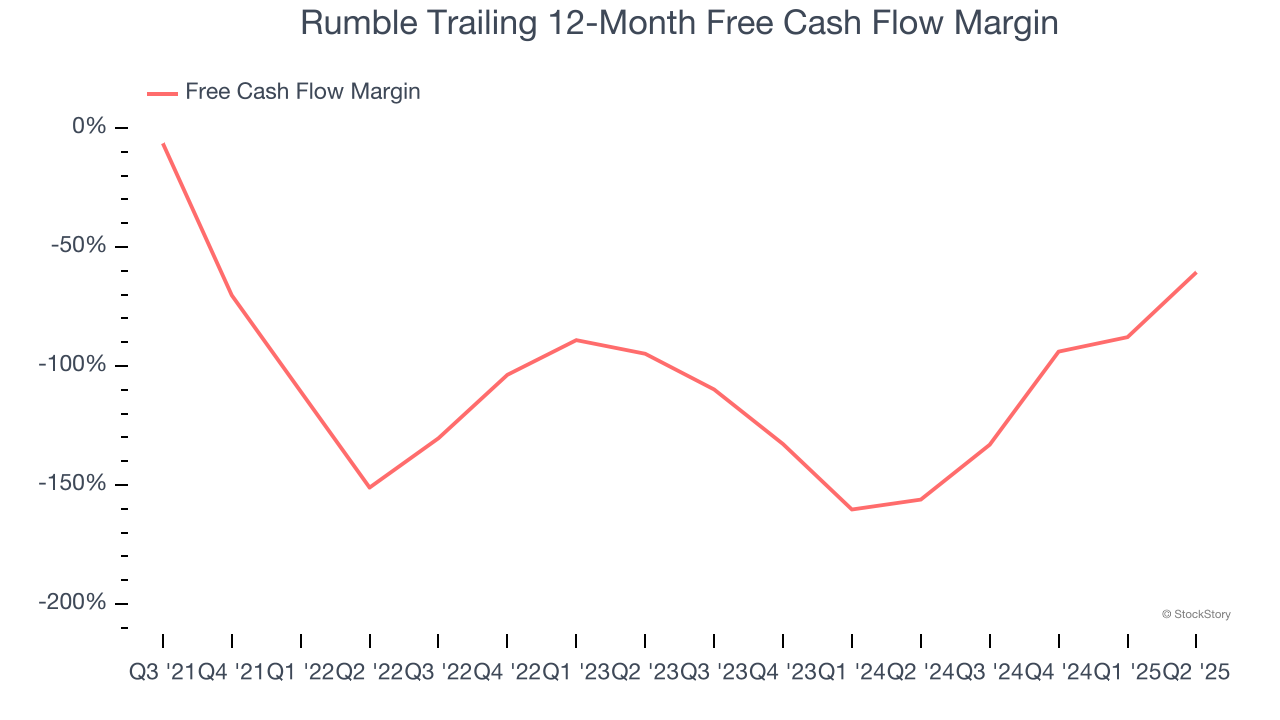

While Rumble posted positive free cash flow this quarter, the broader story hasn’t been so clean. Rumble’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 99.6%, meaning it lit $99.60 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Rumble’s margin dropped by 62.4 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal it’s in the middle of a big investment cycle.

Rumble’s free cash flow clocked in at $2.99 million in Q2, equivalent to a 11.9% margin. Its cash flow turned positive after being negative in the same quarter last year

Key Takeaways from Rumble’s Q2 Results

We struggled to find many positives in these results as its revenue and EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter, but the stock traded up 14.1% to $9.01 immediately after reporting, likely due to Bitcoin and Ethereum's strong price performance over the weekend.

So should you invest in Rumble right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.