Recent Articles from MarketMinute

MarketMinute is a dynamic online platform dedicated to delivering real-time stock news and market insights to investors and enthusiasts alike. Operated by FinancialContent, a leading digital publisher in financial news, the website offers up-to-the-minute updates on stock movements, corporate earnings, analyst ratings, and macroeconomic trends that shape the financial landscape.

Website: https://www.marketminute.com

NEW YORK — As the calendar turns to late January 2026, the U.S. equity markets are not merely climbing; they are accelerating. With the S&P 500 eyeing a historic 7,500 level, the narrative on Wall Street has shifted from "soft landing" to a "policy-driven rocket ship." This surge

Via MarketMinute · January 28, 2026

As of late January 2026, a seismic shift is rattling the foundations of Wall Street. After a multi-year era defined by the undisputed dominance of a handful of tech titans, the long-prophesied "Great Rotation" has finally arrived. The Russell 2000, the bellwether index for small-cap stocks, has surged nearly 8%

Via MarketMinute · January 28, 2026

As of January 28, 2026, the U.S. financial markets are basking in a rare "risk-on" atmosphere, driven by a simultaneous easing of major international conflicts that have haunted global trade for years. With the S&P 500 (INDEXSP:.INX) breaching the 7,200 level for the first time, investors

Via MarketMinute · January 28, 2026

In a surprising turn for the 2026 economy, the University of Michigan’s Consumer Sentiment Index surged to a five-month high of 56.4 in late January, defying gloomy forecasts and a conflicting report from the Conference Board. This unexpected rebound is being fueled by a "fiscal sugar high" as

Via MarketMinute · January 28, 2026

The first month of 2026 has witnessed an unprecedented transformation in the global credit markets. In a historic rush to secure capital for the burgeoning "AI arms race," U.S. corporate bond issuance has shattered previous records, reaching a staggering $95 billion in the first full week of January alone.

Via MarketMinute · January 28, 2026

On January 28, 2026, the S&P 500 reached a momentous milestone, crossing the 7,000-point threshold for the first time in history. While the headline figure suggests a broad-based economic triumph, the underlying mechanics reveal a market more concentrated than ever before. The Information Technology sector now accounts for

Via MarketMinute · January 28, 2026

As of January 28, 2026, the United States is witnessing a historic resurgence in merger and acquisition (M&A) activity, marking a definitive end to the "deal desert" of the early 2020s. Following a landmark 2025 that saw total deal values surge to approximately $2.3 trillion—a staggering 49%

Via MarketMinute · January 28, 2026

In a stunning display of economic resilience, the United States economy has entered 2026 by shattering expectations and effectively silencing critics of a potential recession. Despite a historic 43-day federal government shutdown that delayed official reporting, a flurry of private sector data and the Atlanta Fed’s GDPNow forecast—currently

Via MarketMinute · January 28, 2026

The American technology sector has reached a historic turning point as a record-breaking number of Information Technology companies have issued positive earnings-per-share (EPS) guidance for the first quarter of 2026. Following a transformative 2025 dominated by heavy infrastructure investment, the current earnings season signals a shift from the "build-out" phase

Via MarketMinute · January 28, 2026

As the first month of 2026 draws to a close, a wave of optimism is sweeping through the equity markets, fueled by a rare alignment of fiscal stimulus, aggressive deregulation, and a structural shift in corporate productivity. Major financial institutions have revised their year-end targets for the S&P 500,

Via MarketMinute · January 28, 2026

As the 2026 fiscal year gets into full swing, the American corporate landscape is undergoing a massive transformation fueled by the "One Big Beautiful Act" (OBBBA). Signed into law on July 4, 2025, this sweeping budget reconciliation package—officially Public Law 119-21—has begun to flood the balance sheets of

Via MarketMinute · January 28, 2026

The artificial intelligence sector has entered a new era of "hyper-valuation" following a landmark secondary share sale by OpenAI that valued the San Francisco-based firm at a staggering $500 billion. This milestone, which briefly placed OpenAI among the ranks of the world’s most valuable corporate entities, has served as

Via MarketMinute · January 28, 2026

The global technology landscape is undergoing a tectonic shift as the world’s largest "hyperscalers" abandon their traditional reliance on cash reserves to embrace a historic wave of debt financing. As of late January 2026, industry giants like Amazon.com Inc. (NASDAQ: AMZN) and Alphabet Inc. (NASDAQ: GOOGL) are leading

Via MarketMinute · January 28, 2026

The United States government is once again teetering on the edge of a partial shutdown, as a fierce budget standoff on Capitol Hill threatens to paralyze critical federal agencies by midnight this Friday, January 30, 2026. This latest fiscal cliff comes just months after a historic 43-day shutdown that crippled

Via MarketMinute · January 28, 2026

As the final days of January 2026 unfold, the financial world is fixed on the steps of the U.S. Supreme Court. A landmark decision in the consolidated cases of Learning Resources, Inc. v. Trump and Trump v. V.O.S. Selections, Inc. is expected within weeks, representing the most

Via MarketMinute · January 28, 2026

As the calendar turns toward mid-February, Wall Street is fixated on a single data point: the U.S. Census Bureau’s Advance Monthly Sales for Retail and Food Services report for January 2026. Following a period of intense economic volatility and a Federal Reserve that has shifted into a "cautious

Via MarketMinute · January 28, 2026

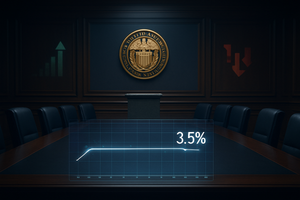

The Federal Reserve has officially entered a period of strategic observation, opting to hold interest rates steady following its first meeting of 2026. This decision, announced today, January 28, 2026, keeps the federal funds rate at a range of 3.50% to 3.75%. While the "pause" was widely anticipated,

Via MarketMinute · January 28, 2026

As the clock struck 2:00 PM in Washington D.C. today, January 28, 2026, the Federal Open Market Committee (FOMC) concluded its first policy meeting of the year with a decision that many expected but few found comforting. In a 10-2 vote, the Federal Reserve elected to maintain the

Via MarketMinute · January 28, 2026

The "Magnificent Seven" technology titans enter the final week of January 2026 facing a paradox of their own making: while their financial might has never been greater, the expectations for their performance have reached a fever pitch. As of January 28, 2026, these seven firms now command a staggering 35%

Via MarketMinute · January 28, 2026

The January 2026 earnings kickoff for the nation’s largest lenders has revealed a United States economy that remains remarkably resilient, even as it navigates the transition to a post-inflationary "soft landing." As JPMorgan Chase (NYSE: JPM) and Wells Fargo (NYSE: WFC) reported their fourth-quarter 2025 results mid-month, the data

Via MarketMinute · January 28, 2026

As the dust settles on the final trading sessions of 2025 and we move through the first month of 2026, the financial community is dissecting a year-end performance that was as historic as it was unconventional. Historically, the months of November and December are the "golden window" for investors, buoyed

Via MarketMinute · January 28, 2026

In a strategic move to solidify its dominance in the burgeoning field of oral anti-inflammatories, Eli Lilly and Company (NYSE:LLY) announced on January 7, 2026, a definitive agreement to acquire Ventyx Biosciences (NASDAQ:VTYX) for approximately $1.2 billion. The all-cash deal, valued at $14.00 per share, marks

Via MarketMinute · January 28, 2026

IBM (NYSE: IBM) reported its fourth-quarter and full-year 2025 financial results today, delivering a performance that underscores its successful pivot from a legacy hardware provider to a dominant force in the enterprise artificial intelligence (AI) and hybrid cloud sectors. Driven by an explosive demand for its watsonx platform and a

Via MarketMinute · January 28, 2026

The US credit market has entered 2026 with a level of momentum unseen in nearly a decade, as a powerful combination of multi-billion dollar mergers and a resurgence in leveraged buyouts (LBOs) drives primary issuance to record heights. Following the Federal Reserve’s pivot toward a more accommodative stance in

Via MarketMinute · January 28, 2026

The latest data from the ADP National Employment Report has become the focal point for a market navigating the precarious transition toward a "soft landing." As of late January 2026, the labor market appears to be in a state of controlled deceleration, adding just enough jobs to prevent a slide

Via MarketMinute · January 28, 2026

As the January 2026 earnings season reaches its fever pitch, the "Magnificent Seven" group of technology titans continues to exert an unprecedented stranglehold on the U.S. equity markets. Accounting for a staggering 35% of the total S&P 500 market capitalization, these seven companies—Apple, Microsoft, Alphabet, Amazon, Nvidia,

Via MarketMinute · January 28, 2026

NEW YORK — Financial markets across the globe have staged a dramatic "V-shaped" recovery this week, as a series of high-stakes diplomatic breakthroughs in Europe and the Middle East effectively dismantled a month-long "fear trade." The rally, which gathered momentum following the conclusion of the World Economic Forum in Davos, has

Via MarketMinute · January 28, 2026

As the 2026 tax filing season begins, the American economy is navigating a radical transformation defined by Treasury Secretary Scott Bessent’s "non-inflationary boom" strategy. This ambitious economic experiment, centered on the "One Big Beautiful Bill" (OBBB)—officially the Working Families Tax Cut Act—represents the most significant shift in

Via MarketMinute · January 28, 2026

In a move that underscores the insatiable appetite for reliable electricity in the age of artificial intelligence, Vistra Corp (NYSE: VST) announced on January 5, 2026, a definitive agreement to acquire Cogentrix Energy for approximately $4.7 billion. The acquisition, which targets a massive 5,500-megawatt (MW) portfolio of natural

Via MarketMinute · January 28, 2026

The US Dollar Index (DXY) has finally breached the critical psychological support level of 96.00, marking a dramatic shift in the global financial landscape as of late January 2026. This decline, which saw the index drop to its lowest level since February 2022, reflects a confluence of aggressive Federal

Via MarketMinute · January 28, 2026

After nearly two months of grueling sideways consolidation that tested the patience of even the most seasoned growth investors, the Nasdaq 100 (NASDAQ:NDX) has finally broken free. On Tuesday, January 27, and continuing through the morning of Wednesday, January 28, 2026, the tech-heavy index surged past the critical 25,

Via MarketMinute · January 28, 2026

In a pivotal moment for the world’s largest coffeehouse chain, Starbucks (NASDAQ: SBUX) shares surged nearly 10% on Wednesday, January 28, 2026, following the release of its fiscal first-quarter earnings. Despite a slight miss on the bottom line, investors ignored the earnings per share (EPS) shortfall, instead fixating on

Via MarketMinute · January 28, 2026

Boeing (NYSE: BA) reported its fourth-quarter and full-year 2025 financial results on January 27, 2026, marking what many analysts are calling a pivotal "industrial reset" for the aerospace giant. After a multi-year period defined by safety crises and production caps, the company posted a surprising net profit of $8.22

Via MarketMinute · January 28, 2026

MARLBOROUGH, Mass. — In a move that has sent shockwaves through the medical technology landscape, Boston Scientific (NYSE: BSX) announced on January 15, 2026, a definitive agreement to acquire Penumbra (NYSE: PEN) for an enterprise value of approximately $14.5 billion. The deal, representing Boston Scientific’s largest acquisition in over

Via MarketMinute · January 28, 2026

In a move that signals a seismic shift within the consumer staples landscape, Kimberly-Clark (NYSE:KMB) is on the precipice of finalizing its $48.7 billion acquisition of Kenvue (NYSE:KVUE). This colossal deal, if ratified by shareholders tomorrow, January 29, 2026, would create a diversified powerhouse with a formidable

Via MarketMinute · January 28, 2026

In a widely anticipated move that underscores the complexity of the current economic landscape, the Federal Reserve’s Federal Open Market Committee (FOMC) voted today, January 28, 2026, to maintain the federal funds rate at a target range of 3.50% to 3.75%. This "hawkish hold" marks a definitive

Via MarketMinute · January 28, 2026

AUSTIN, Texas — As Tesla (NASDAQ: TSLA) reports its fourth-quarter 2025 earnings today, January 28, 2026, the company finds itself at the most critical juncture in its twenty-year history. Once defined by its dominance in the global electric vehicle (EV) market, the company is now fully rebranding itself as an artificial

Via MarketMinute · January 28, 2026

As the sun rises on the final days of January 2026, the financial world has its eyes fixed on a single entity: Meta Platforms (NASDAQ: META). Following a turbulent 2025 that saw the social media giant grapple with a "death cross" and fluctuating investor sentiment, the company is set to

Via MarketMinute · January 28, 2026

As the closing bell approaches on January 28, 2026, the financial world has its eyes fixed on Redmond. Microsoft (NASDAQ: MSFT) is set to report its fiscal second-quarter earnings for 2026, a report that many analysts are calling a "referendum on the AI era." After more than two years of

Via MarketMinute · January 28, 2026

Wall Street reached a monumental psychological and financial peak on Wednesday as the S&P 500 index briefly eclipsed and then closed near the 7,000-point mark for the first time in history. This breakthrough, occurring on January 28, 2026, represents a staggering 16.6% climb from the 6,000-point

Via MarketMinute · January 28, 2026

The financial world pivots toward the end of January 2026, and all eyes are on Meta Platforms, Inc. (NASDAQ: META), which is set to report its fourth-quarter 2025 earnings in the coming days. In a significant move that has rattled some corners of the market while reassuring others, Bank of

Via MarketMinute · January 28, 2026

The United States labor market continues to exhibit a remarkable, if paradoxical, resilience as the first month of 2026 draws to a close. According to the latest data released this morning, weekly initial jobless claims rose slightly to 200,000 for the week ending January 17—a figure that notably

Via MarketMinute · January 28, 2026

In a definitive signal that the "M&A winter" has finally thawed, Morgan Stanley (NYSE: MS) delivered a staggering fourth-quarter and full-year 2025 earnings report this month, far exceeding Wall Street’s most optimistic projections. The results, released in mid-January, showcase a firm firing on all cylinders, with a 47%

Via MarketMinute · January 28, 2026

DETROIT — January 28, 2026 — General Motors (NYSE: GM) has once again defied industry skeptics, reporting a resilient fourth-quarter performance that underscores its transition from a volume-focused automaker to a lean, earnings-per-share powerhouse. On the heels of a fiscal year defined by record-breaking internal combustion engine (ICE) sales and a disciplined

Via MarketMinute · January 28, 2026

The landscape of American telecommunications reached a historic turning point on January 20, 2026, as Verizon Communications Inc. (NYSE: VZ) officially finalized its $20 billion acquisition of Frontier Communications. The closing of the deal marks the culmination of a multi-year effort to pivot from a wireless-centric business model to a

Via MarketMinute · January 28, 2026

As the market approaches the end of January 2026, the narrative surrounding the technology sector has undergone a seismic shift. Alphabet Inc. (NASDAQ: GOOGL), once plagued by concerns that it was falling behind in the generative AI race, has emerged as the clear darling of Wall Street. A flurry of

Via MarketMinute · January 28, 2026

The semiconductor industry was sent into a tailspin this week as Intel Corp. (Nasdaq: INTC) reported fourth-quarter 2025 financial results that, while exceeding immediate expectations, painted a grim picture for the year ahead. Despite a revenue beat and a surprising jump in adjusted earnings for the final quarter of 2025,

Via MarketMinute · January 28, 2026

In a move that fundamentally reshapes the global hygiene landscape, The Clorox Company (NYSE: CLX) announced on January 22, 2026, that it has entered into a definitive agreement to acquire GOJO Industries, the privately held manufacturer of the iconic Purell hand sanitizer brand. The $2.25 billion all-cash transaction represents

Via MarketMinute · January 28, 2026

In a move that signals a tectonic shift in the financial services landscape, Capital One Financial Corp. (NYSE:COF) announced on January 22, 2026, that it has entered into a definitive agreement to acquire the high-growth fintech firm Brex for $5.15 billion. The deal, structured as a 50/50

Via MarketMinute · January 28, 2026

As the final week of January 2026 unfolds, Wall Street is bracing for a high-stakes "triple-header" of earnings reports that will define the trajectory of the global economy for the next two years. With Microsoft, Meta, and Tesla all scheduled to report results after the bell today, January 28, 2026,

Via MarketMinute · January 28, 2026

American consumer confidence plummeted in January 2026, reaching its lowest level in over a decade as the combined weight of political instability in Washington and persistent inflationary pressures took a heavy toll on household outlooks. The Conference Board reported on Tuesday that its Consumer Confidence Index fell to 84.5,

Via MarketMinute · January 28, 2026

The global financial landscape has been pushed to the brink this January 2026 as an unprecedented trade dispute over the status of Greenland sent shockwaves through international markets. The crisis, sparked by the second Trump administration’s aggressive push to secure the resource-rich territory, saw the United States threaten a

Via MarketMinute · January 28, 2026

In a historic blow to the managed care sector, UnitedHealth Group (NYSE: UNH) saw its stock price plunge nearly 20% on Tuesday, marking its worst single-day performance in over three decades. The massive selloff, which erased approximately $80 billion in market value, was triggered by a surprisingly lean 2027 Advance

Via MarketMinute · January 28, 2026

The 'One Big Beautiful Bill Act' (OBBBA), formally signed into law on July 4, 2025, has officially entered its first full month of implementation, unleashing a $285 billion fiscal wave that is fundamentally altering the math of American industry. While the legislation covers a broad swathe of tax and social

Via MarketMinute · January 28, 2026

The tech-heavy Nasdaq is currently locked in a high-stakes tug-of-war as it approaches a critical technical resistance level at 25,850. After a volatile start to the year, market participants are laser-focused on this threshold, which many analysts believe is the final gatekeeper before the index makes a run for

Via MarketMinute · January 28, 2026

The financial world is collectively holding its breath as the S&P 500 (NYSEARCA: SPY) hovers at 6,979, just a stone's throw away from the psychologically momentous 7,000-point milestone. After a volatile start to 2026, technical analysts are laser-focused on whether the index can punch through this "Gamma

Via MarketMinute · January 28, 2026

As the Federal Reserve convenes for its first policy meeting of 2026, investors are breathing a collective sigh of relief. The latest Personal Consumption Expenditures (PCE) price index—the central bank’s preferred metric for measuring inflation—held steady at a 2.8% annual rate. While this figure remains stubbornly

Via MarketMinute · January 28, 2026

As the S&P 500 continues its ascent in early 2026, a fundamental shift has quietly redefined the mechanics of the bull market. For years, skeptics pointed to "multiple expansion"—the phenomenon where stock prices rise faster than profits—as evidence of a brewing bubble. However, new data as of

Via MarketMinute · January 28, 2026

The dawn of 2026 has brought a seismic shift to global equity markets, as the long-anticipated "Great Rotation" finally takes hold. After nearly three years of dominance by a handful of mega-cap technology titans, investors are aggressively reallocating capital toward small-cap and mid-cap sectors. This movement has created a stark

Via MarketMinute · January 28, 2026

The European Union’s ambitious roadmap toward a carbon-neutral continent has hit a significant roadblock as 2026 begins: a structural "feedstock crunch" that is driving price volatility across agricultural and waste-based commodity markets. As the ReFuelEU Aviation mandate—which required a 2% sustainable aviation fuel (SAF) blend starting in 2025—

Via MarketMinute · January 28, 2026

In a move that underscored the complexity of the current "Great Normalization" era, the Federal Reserve concluded its first meeting of 2026 by electing to hold the federal funds rate steady at the 3.5%–3.75% range. This decision, announced today, January 28, 2026, marks a definitive pause in

Via MarketMinute · January 28, 2026

As of January 2026, the European aluminum market is grappling with a structural "supply-side squeeze" that has pushed the recycling sector to the brink of a historic transformation. A severe shortage of aluminum scrap across the continent has decoupled secondary metal prices from global primary benchmarks, driving secondary ingot prices

Via MarketMinute · January 28, 2026

In a historic shift that signals the end of an era for North American energy trade, Mexico’s state-owned oil giant, Petróleos Mexicanos (Pemex), saw its crude oil exports plummet to a 35-year low in December 2025. Data released late last month reveals that exports dropped to approximately 368,000

Via MarketMinute · January 28, 2026

As of late January 2026, the global agricultural market finds itself in a state of "bearish stability"—a precarious equilibrium where high production volumes from the 2025 harvest are being countered by intensifying logistical risks and a permanent geopolitical risk premium. While global supplies of wheat and corn remain relatively

Via MarketMinute · January 28, 2026

In a definitive signal of its operational recovery, Vale S.A. (NYSE: VALE) has announced that its 2025 iron ore production exceeded the upper limit of its annual guidance, effectively reclaiming its title as the world’s largest iron ore producer. The Brazilian mining giant reported a total output of

Via MarketMinute · January 28, 2026

As the global energy landscape navigates the early weeks of 2026, a chilling forecast from Moscow has sent ripples through international markets. Internal reports and stress tests from the Central Bank of Russia and the Roscongress Foundation suggest that Urals crude, the nation’s primary export blend, could settle at

Via MarketMinute · January 28, 2026

As of January 28, 2026, the global trade landscape has reached a definitive crossroads. Following years of grueling negotiations, the European Union and India officially concluded talks on a landmark Free Trade Agreement (FTA) yesterday, January 27. While heralded as the "mother of all deals," the agreement has failed to

Via MarketMinute · January 28, 2026

Industrial markets reached a major inflection point this week as aluminum prices surged to a fresh multi-year peak, driven by a perfect storm of tightening global supply and a plummeting U.S. currency. On January 28, 2026, the light metal hit $3,289.55 per tonne on the London Metal

Via MarketMinute · January 28, 2026

The global natural gas market witnessed an extraordinary "great divergence" in December 2025, as a brutal cold snap in North America sent domestic prices soaring while a mild, windy winter in Europe allowed the continent’s energy crisis fears to cool. U.S. natural gas futures surged by 12.1%

Via MarketMinute · January 28, 2026

The global economy is entering a period of significant deflationary pressure within the raw materials sector as the World Bank’s latest Commodity Price Outlook projects a sustained downturn through 2026. Driven by a historic surplus in crude oil and a sharp deceleration in demand from traditional industrial powerhouses, aggregate

Via MarketMinute · January 28, 2026

The global financial markets are witnessing a paradigm shift in the precious metals sector as silver prices recently surged past the historic $95 per ounce threshold, a valuation that would have been unthinkable just two years ago. This meteoric rise represents a gain of over 200% since the beginning of

Via MarketMinute · January 28, 2026

The landscape of the global gold mining sector has undergone a seismic shift over the last six months, punctuated by a fundamental restructuring of the industry’s most significant investment vehicle and a massive capital injection from the East. As gold prices hover near historic highs of $5,000 per

Via MarketMinute · January 28, 2026

In a move that has sent shockwaves through global commodities markets, Goldman Sachs has aggressively revised its year-end 2026 gold price forecast to $5,400 per ounce. This significant upgrade, coming as spot gold prices hover just above the $5,100 mark today, January 28, 2026, represents a bold bet

Via MarketMinute · January 28, 2026

In a month that has redefined the landscape of global stability, precious metals have surged to unprecedented heights as a "perfect storm" of geopolitical interventions, military strikes, and trade warfare sends investors scrambling for safety. As of January 28, 2026, the global financial order is facing its most significant test

Via MarketMinute · January 28, 2026

In a day that will be etched into the annals of financial history, precious metals have staged a monumental breakout, redefining the global valuation of hard assets. Gold futures officially closed at a staggering $4,908.80 per ounce, while silver breached the $95 mark for the first time, ending

Via MarketMinute · January 28, 2026