Sprott Nickel Miners ETF (NIKL)

11.66

-0.17 (-1.44%)

NASDAQ · Last Trade: Jun 17th, 11:45 PM EDT

Detailed Quote

| Previous Close | 11.83 |

|---|---|

| Open | 11.88 |

| Day's Range | 11.61 - 11.88 |

| 52 Week Range | 7.250 - 13.94 |

| Volume | 18,303 |

| Market Cap | - |

| Dividend & Yield | 0.3720 (3.19%) |

| 1 Month Average Volume | 23,616 |

Chart

News & Press Releases

Trump invokes DPA to boost domestic mineral industry, citing national security concerns. Expands list of priority minerals to include uranium.

Via Benzinga · March 21, 2025

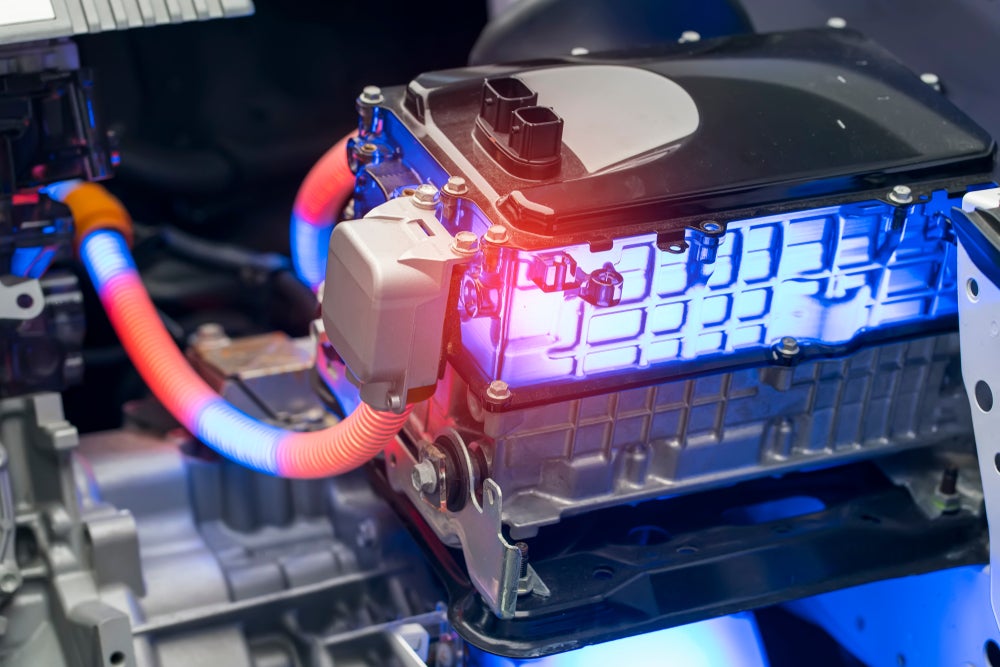

Nickel - The Unsung Hero Powering The Green Revolution?

--News Direct--

Via News Direct · June 7, 2024

The EV industry is facing a major shift as lithium and nickel producers pause projects and shut down mines due to plummeting commodity prices, impacting investment and slowing growth.

Via Benzinga · February 19, 2024

Over the last four decades, Sprott Asset Management has established itself as a trusted global asset management firm. Amongst the company’s most compelling products is its Nickel Miners ETF - NIKL (NASDAQ: NIKL).

Via Benzinga · August 22, 2023

With the transition to clean energy running in full gear, the minerals and metals powering the EV battery supply chain are in focus.

Via Benzinga · July 27, 2023

The transition towards low-carbon, clean energy solutions is continuing to pick up pace, and with it, the demand for critical minerals is projected to continue increasing. Critical minerals are the natural resources necessary to generate, transmit and store low-carbon energy.

Via Benzinga · July 6, 2023

Sprott Asset Management, a subsidiary of Sprott Inc. (NYSE: SII), is a leading global exchange-traded funds (ETFs) asset manager with a specialty in precious metals and energy transition investments.

Via Benzinga · June 29, 2023

Thematic exchange-traded funds (ETFs) take advantage of long-term market trends, and the portfolios for these funds are often involved in industry-shaping innovations.

Via Benzinga · June 13, 2023