State Street SPDR Bloomberg 1-3 Month T-Bill ETF (BIL)

91.47

+0.02 (0.02%)

NYSE · Last Trade: Feb 12th, 2:14 AM EST

Detailed Quote

| Previous Close | 91.45 |

|---|---|

| Open | 91.46 |

| Day's Range | 91.46 - 91.47 |

| 52 Week Range | 91.26 - 91.78 |

| Volume | 5,732,274 |

| Market Cap | 417.42M |

| Dividend & Yield | 4.380 (4.79%) |

| 1 Month Average Volume | 9,394,087 |

Chart

News & Press Releases

UiPath delivers automation software and AI-driven solutions to enterprise clients across banking, healthcare, and government sectors.

Via The Motley Fool · February 3, 2026

First Trust Enhanced Short Maturity ETF seeks income and capital preservation with a diversified mix of short-term debt securities.

Via The Motley Fool · February 2, 2026

Ramaco Resources supplies metallurgical coal to steelmakers from integrated mining operations across key U.S. regions.

Via The Motley Fool · January 24, 2026

Via MarketBeat · November 30, 2025

Via The Motley Fool · October 21, 2025

Via The Motley Fool · October 21, 2025

Via The Motley Fool · October 21, 2025

US-listed ETFs saw $19B inflows, with bond ETFs leading at $15.3B. Investors betting on Fed rate cuts, favoring short-term Treasury exposure.

Via Benzinga · August 12, 2025

Trump's policies and fiscal hawkishness are causing Treasury yields to rise, making short-term bonds more attractive for investors seeking stability and yield.

Via Benzinga · June 3, 2025

New ETF, BOBP, captures opportunities with dynamic rebalancing and quantitative triggers. Its portfolio is constructed using behavioral finance and statistical patterns.

Via Benzinga · May 27, 2025

Billionaire investor Chamath Palihapitiya is sounding the alarm on an ominous new sign for the markets, hinting at a major shift in sentiments over the past couple of weeks.

Via Benzinga · May 27, 2025

The biggest Treasury bond ETFs moved higher, reminding investors why bonds remain a cornerstone of portfolio stability.

Via Benzinga · April 11, 2025

Warren Buffett holds $150B in bonds. Discover why it’s not bearish—and how retail investors can profit from this smart setup.

Via MarketBeat · April 7, 2025

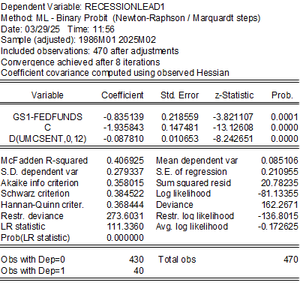

Looking at the determinants makes one understand why the estimated recession likelihood is high. That said, aside from consumption, there’s been little sign of a recession in contemporaneous, hard-data indicators.

Via Talk Markets · March 30, 2025

Wall Street has endured a sharp market downturn amid ongoing tariff disputes, rising inflation, and heightening recession fears. This market environment has raised demand for cash-like ETFs. Here are some such funds to consider.

Via Talk Markets · March 15, 2025

Investors flock to short-term bond ETFs amid recession fears and market volatility. Top performers include SGOV, BIL, and JPST.

Via Benzinga · March 11, 2025

This week's inflation data comes at a really important point for the market.

Via Talk Markets · January 11, 2025

In this week's video, we'll review the latest charts and data to help us answer the question - will the election bring a sharp correction in stocks?

Via Talk Markets · October 26, 2024

The Fed's 0.5% interest rate cut may lead to a shift from money market funds to longer duration bonds, as investors seek higher yields.

Via Benzinga · September 20, 2024

Wall Street has grappled with overvaluation in tech and economic slowdown concerns. With nearly two dozen ETFs in this sector, choosing popular ones might be a smart move.

Via Talk Markets · August 14, 2024

In this week's video, we'll review the latest charts to help us answer the question - are we looking at a bare Market, a correction, a pullback healthy rotation, or higher highs on the way?

Via Talk Markets · July 20, 2024

In this week's video, we'll review the latest charts, data, and model scores to help us answer the question: Are the charts pointing to the end of the bull market?

Via Talk Markets · July 13, 2024

US Treasuries steady despite volatile start to 2024, as Fed may cut rates due to falling prices. Bonds now seen as valuable in portfolio.

Via Benzinga · June 20, 2024

In this week's video, we'll demonstrate why there's an important message in a small group of not-so-widely followed charts.

Via Talk Markets · May 11, 2024

Overall, ETFs pulled in $24.5 million in capital last week, taking year-to-date inflows to $196.4 billion.

Via Talk Markets · April 16, 2024