Vanguard Extended Duration Treasury ETF (EDV)

65.88

+0.78 (1.20%)

NYSE · Last Trade: Jan 11th, 8:13 PM EST

Detailed Quote

| Previous Close | 65.10 |

|---|---|

| Open | 65.09 |

| Day's Range | 64.90 - 65.97 |

| 52 Week Range | 61.56 - 73.68 |

| Volume | 2,369,620 |

| Market Cap | 35.11M |

| Dividend & Yield | 3.244 (4.92%) |

| 1 Month Average Volume | 1,073,292 |

Chart

News & Press Releases

Markets fear Fed independence threatened by ousting of Lisa Cook and potential for more dovish board members, causing volatility in bond ETFs

Via Benzinga · August 26, 2025

Via The Motley Fool · July 14, 2025

Trump-Powell drama escalates again, shocking the currency markets, where central bank independence is viewed as a cornerstone of stability.

Via Benzinga · April 21, 2025

The Blind Squirrel's Weekly Notes. March 20th, 2023

Via Talk Markets · March 19, 2023

Via The Motley Fool · April 5, 2025

Via The Motley Fool · March 3, 2025

Now could be a great opportunity to buy long-term bonds. Here are two ways to do it.

Via The Motley Fool · September 14, 2024

These funds could get a boost as interest rates drop and stay low for an extended time.

Via The Motley Fool · September 7, 2024

The IMF is concerned about highly-leveraged hedge funds dominating the U.S. Treasury futures market, which could lead to systemic threats and instability in the global economy.

Via Benzinga · April 18, 2024

Companies Reporting Before The Bell • Local Bounti (NYSE:LOCL) is projected to report quarterly loss at $2.41 per share on revenue of $8.70 million.

Via Benzinga · March 27, 2024

They aren't as popular as Vanguard's S&P 500 ETF, but could benefit as interest rates fall.

Via The Motley Fool · February 4, 2024

All five of these could be great long-term investments but look especially strong right now.

Via The Motley Fool · February 1, 2024

Early 2024 could be a great time to build out your portfolio's fixed-income allocation.

Via The Motley Fool · January 30, 2024

Endeavour appointed Ian Cockerill, the Deputy Chairman, as the new CEO, effective immediately.

Via Benzinga · January 5, 2024

Explore the top-performing ETFs in November 2023 were over potential Federal Reserve rate cuts amid cooling inflation and dovish remarks.

Via Benzinga · November 30, 2023

While most of the ETFs in the Treasury space are surging, here are five that are leading the way higher this month.

Via Talk Markets · November 28, 2023

Via Benzinga · October 24, 2023

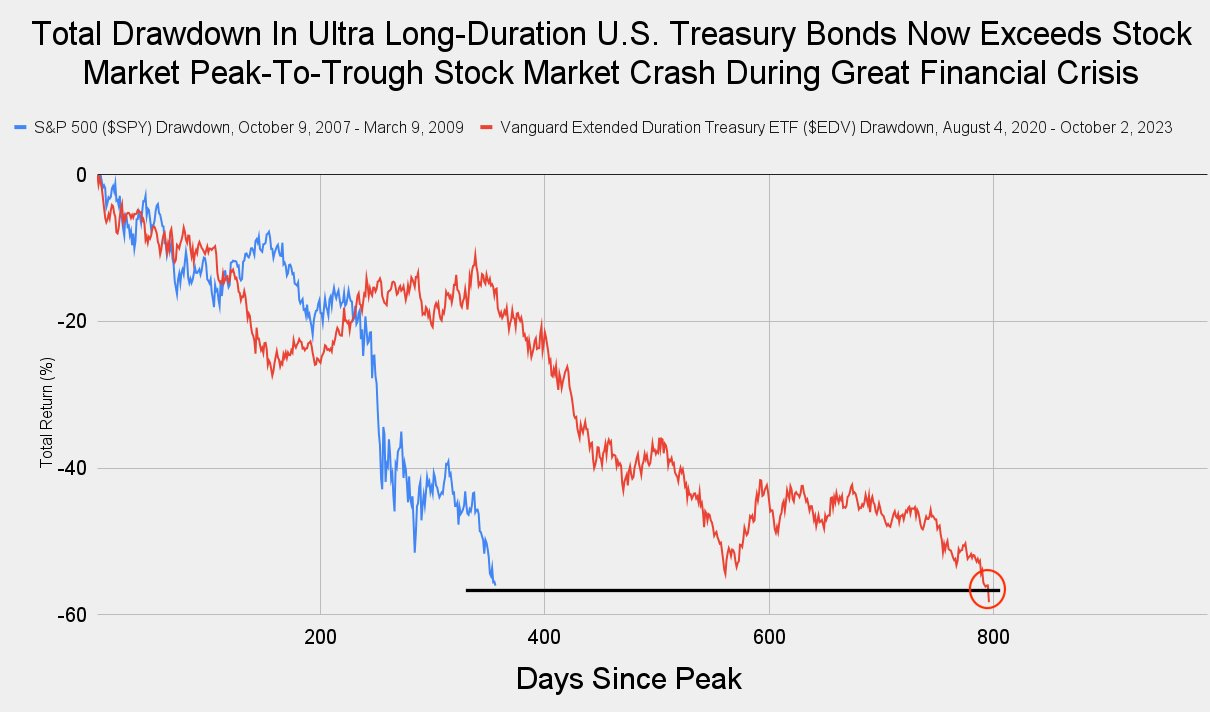

The bond market's current fall is now greater than that recorded by the equity market during the last financial crisis in 2008.

Via Talk Markets · October 6, 2023

Net-short leveraged positions in 10-year Treasury futures by hedge funds have reportedly grown to the largest levels since 2019 while net-long positions taken by institutional investors have risen to record leve

Via Benzinga · January 23, 2023

Japanese institutional managers are fueling the bond selloff just as the Federal Reserve pares its $9 trillion balance sheet, writes Bloomberg.

The latest data from BMO...

Via Benzinga · May 2, 2022

The mid-tier and junior gold miners in their sector’s sweet spot for upside potential have powered higher in recent months.

Via Talk Markets · March 25, 2022